Last week I asked: What kind of nation penalizes its poorest children?

Unfortunately, congressional Republican leadership keep deciding that the U.S. should impose “baby and child penalties” in the Child Tax Credit. This policy exacerbates child poverty by outright denying or allowing only partial payments to low-income children and their families. The consequence is that children most in need get the very least.

As the comprehensive National Academy of Sciences, Engineering, and Medicine (NASEM) report on how to cut child poverty found, by simply making the Child Tax Credit fully refundable, the U.S. could cut child poverty by nearly half.

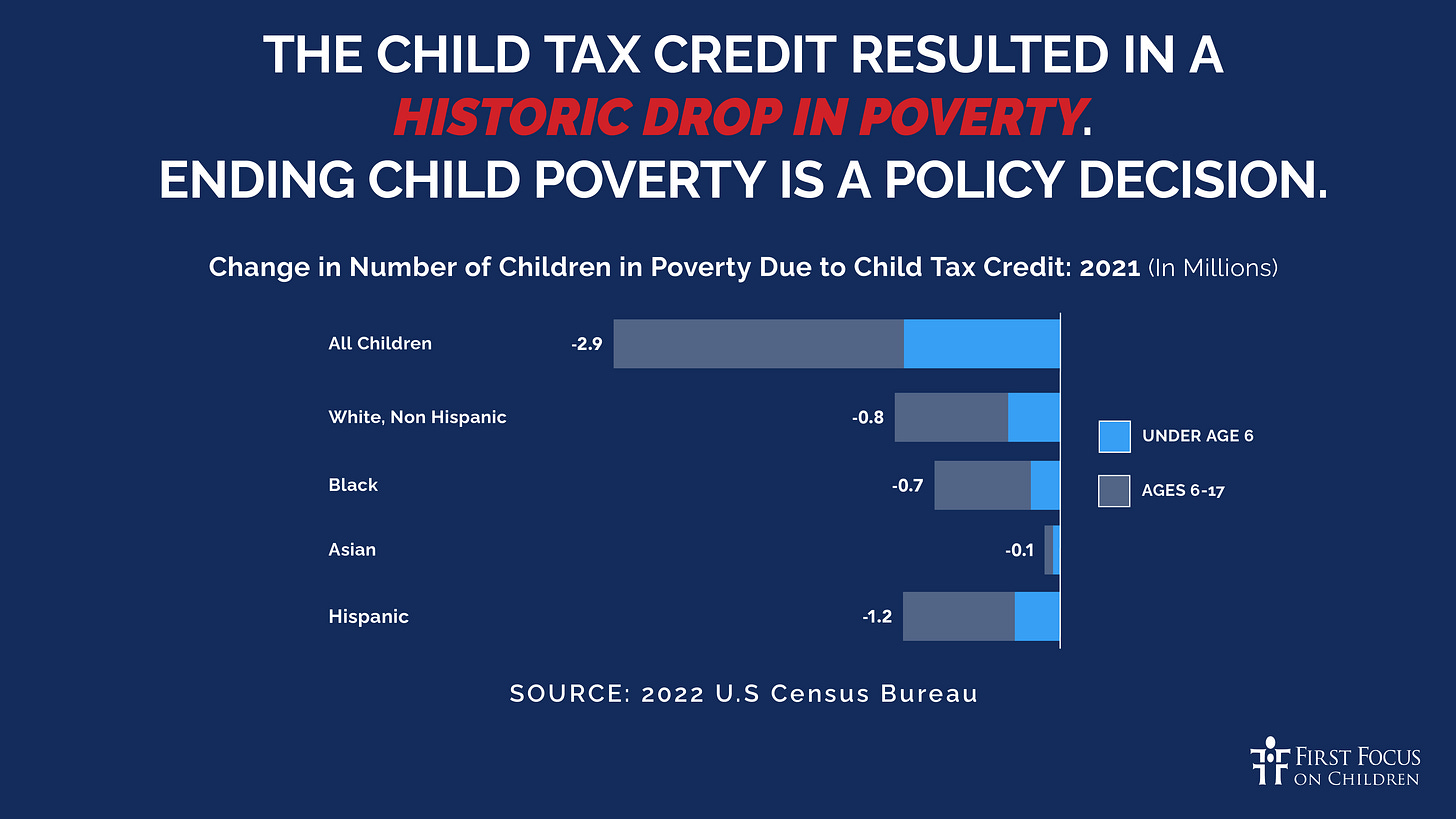

In 2021, Congress did just that. Lawmakers expanded and made the Child Tax Credit fully refundable on a temporary basis. This change, in conjunction with other policies, cut child poverty to a record low 5.2%.

The policy change in 2021 ensured that 19 million low-income children were no longer “left behind” and could receive the full credit, which single-handedly lifted 2.9 million children out of poverty.

Unfortunately, the improved Child Tax Credit expired at the close of 2021, and child poverty more than doubled to 13.7% or 10 million children.

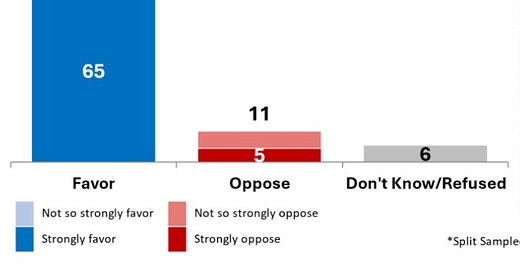

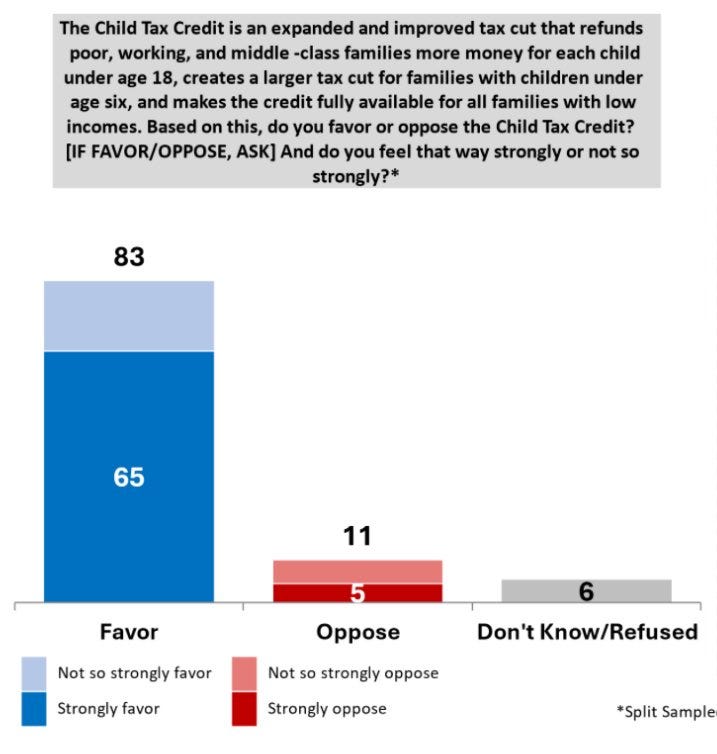

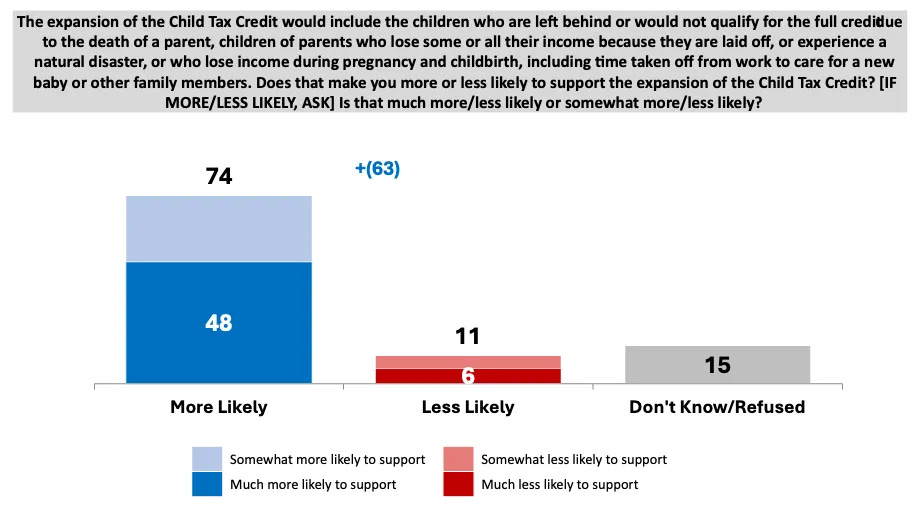

This is not the direction that the American people believe we should be heading. In a poll from April 2025, Lake Research Partners found that voters supported a fully refundable and expanded Child Tax Credit by an 83-11% margin.

Child poverty is a policy choice. Right now, Congress is doling out well over $3 trillion in tax cuts – mostly to corporations, wealthy older individuals, and to some wealthy children through an expansion of the estate tax. If it wanted to, Congress could instead help kids most in need by eliminating the “baby and child penalties” imposed on low-income children in the Child Tax Credit.

In addition, just as Social Security is automatically adjusted for inflation, children and families need the Child Tax Credit to be adjusted to account for inflation. Since 2017, when the $2,000 Child Tax Credit was initially enacted, inflation has increased by 31%. Thus, to fully account for inflation, the Child Tax Credit would need to be $2,630 per child to maintain its purchasing power.

The choices now in front of Congress aren’t just about policy variations. Budgets and policies should reflect how and what our nation values, including its children and grandchildren.

The following provides a summary of the Child Tax Credit proposals that are being considered in Congress and how they will impact low- and middle-class children and their families.

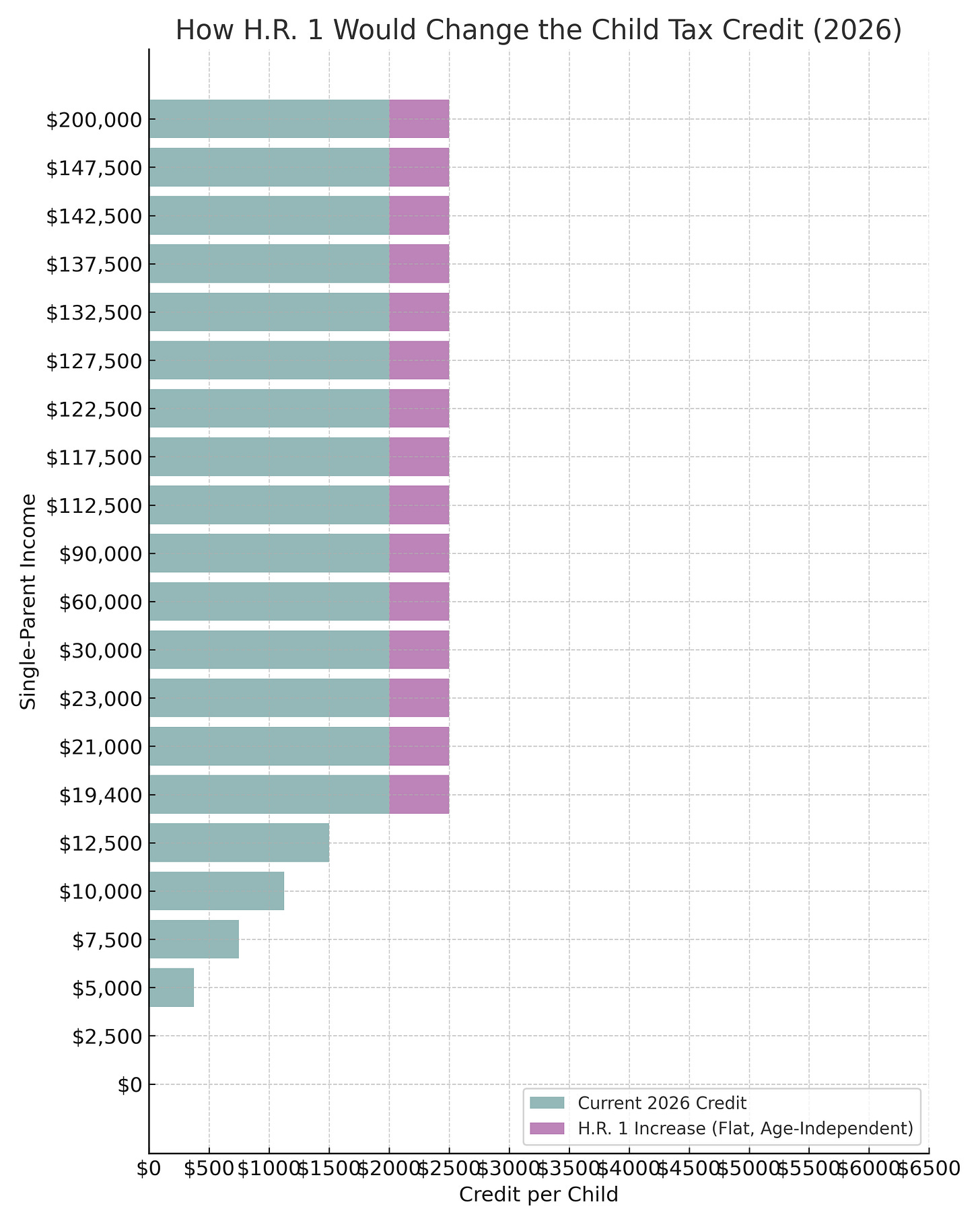

H.R. 1: A Tax Credit That Leaves Millions Behind

H.R. 1 recently passed the House of Representatives by a 215-214 margin and includes the following changes to the Child Tax Credit:

Raises the CTC slightly, from $2,000 under current law to $2,500, through 2028. This amount falls short of the $2,630 needed to fully account for inflation.

Leaves an estimated 22 million children (or 1-in-3 children) behind, shortchanging those who have lower incomes with either only partial or no credit.

Denies the credit to 4.5 million U.S. citizen children in mixed-status families, as it requires both parents of U.S. citizen children to have Social Security numbers to qualify

Offers no monthly payments.

Offers no additional benefit for younger children, despite evidence that early investment pays lifelong dividends and President Trump had talked about some type of baby bonus.

Lets the increase expire, reverting back to $2,000 after 2028.

Consequently, H.R. 1 entrenches some structural flaws in the Child Tax Credit by disproportionately leaving behind 22 million low-income children who need the credit the most. H.R. 1 also leaves 4.5 million U.S. citizen children worse off by denying them the credit due to the immigration status of a parent.

The Senate’s Proposal: Too Little, Too Late

Vice President JD Vance, when he was a senator and again on the campaign trail in 2024, claimed that he supported a $5,000 Child Tax Credit.

On the Senate floor earlier this year, Sen. Josh Hawley (R-MO) called for an increase to the Child Tax Credit to $5,000 per child. Sen. Hawley also called for improvements that would credit the first dollar earned against payroll taxes to improve the refundable portion of the Child Tax Creidt, making it available through periodic payments throughout the year, and expanding it to pregnant women.

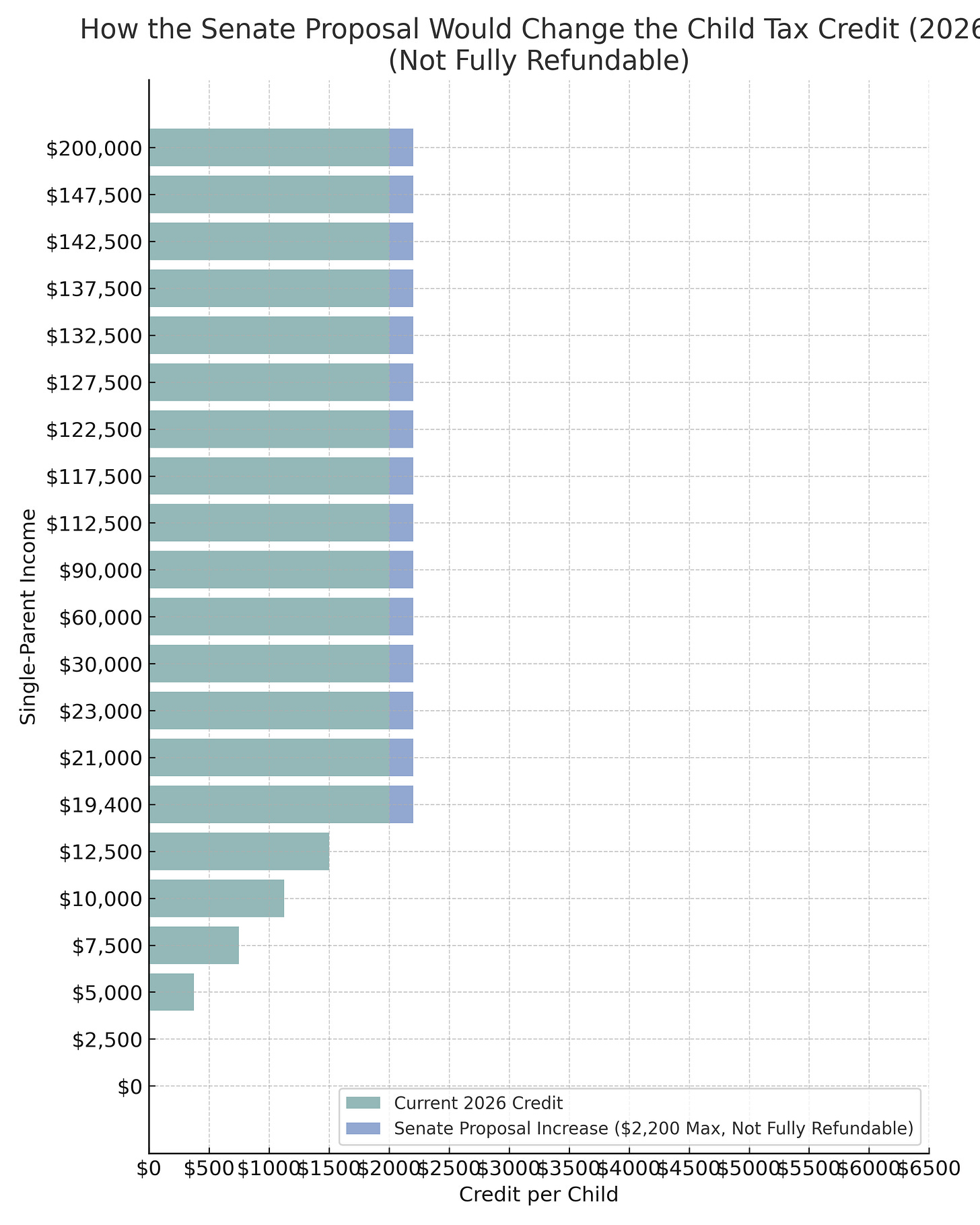

On Monday, Senate Finance Committee Republicans released their tax proposal. Unfortunately, it does not make the Child Tax Credit fully refundable and leaves tens of millions of children behind. Here is quick summary of that proposal:

Increases the credit to $2,200 per-child, which is far short of the $2,630 to fully account for inflation.

Like current law and the House bill, the legislation leaves over 20 million children behind, as it provides only partial or no support to the lowest-income kids who need the credit the most.

Denies the credit to millions of U.S. citizen children in mixed-status families, as it requires a parent of U.S. citizen children to have Social Security numbers to qualify

Offers no monthly payments.

Offers no additional benefit for younger children, despite evidence that early investment pays lifelong dividends and President Trump had talked about some type of baby bonus.

Although the language is a bit confusing, the proposal appears to make the $2,200 credit permanent and index it to inflation.

Here’s how the Senate proposal stacks up:

The result is a policy that might look like slight progress at first glance ($2,200 credit) — but in practice, it continues to leave behind over 20 million low-income children with no or only partial access to the Child Tax Credit. It also denies millions of U.S. citizen children access to the Child Tax Credit due to the immigration status of their parents.

The American Family Act: Counting and Valuing All Children

Senate and House Democrats put forth another alternative: the American Family Act, which was introduced earlier this year by Rep. Rosa DeLauro (D-CT) and Sen. Michael Bennet (D-CO) and would:

Raise the Child Tax Credit to:

$6,360 for newborns;

$4,320 for children ages 1–6; and,

$3,600 for children up to age 18.

Make the credit fully refundable, ensuring families receive the full amount regardless of income and leaving no low-income children behind.

Provide monthly payments to help families pay bills in real time.

Include all U.S. citizen children.

Extends the Child Tax Credit to children in all U.S. territories.

Index the credit to inflation.

Here’s what that looks like for a single parent with one child:

When you compare the plans: it is not even close.

The American Family Act doesn’t just boost support for children and families: it targets support where it’s needed the most, prioritizing babies and toddlers for increased support when brain development and family stability are critically important.

Why This Debate Matters

Senate Majority Leader John Thune (R-SD) recently suggested that Congress must choose between H.R. 1 and letting the credit fall back to just $1,000.

Senate Leader Thune and Rep. Derrick Evans (R-WV) present a false choice. There are better options readily available, including the American Family Act.

The American Family Act doesn’t just reduce child poverty: it embraces a different set of values with respect to children that were originally proposed 34 years ago.

That proposal by the National Commission on Children, which was created under President Ronald Reagan and released a 1991 report to President George Bush, explained:

The United States is the only Western industrialized nation that does not have a child allowance policy or some other universal, public benefit for families raising children…. Other nations that have adopted child allowance policies regard such subsidies as an investment in their children’s health and development and in their nation’s future strength and productivity.

To improve the lives, well-being, and future of children, the National Commission on Children’s report, Beyond Rhetoric: A New American Agenda for Children and Families, recommended that the Child Tax Credit go to all families with children and not be withheld in whole or in part from its poorest children and families.

The Commission proposed:

Because it would assist all families with children, the refundable child tax credit would not be a relief payment, nor would it categorize children according to their “welfare” or “nonwelfare” status. In addition, because it would not be lost when parents enter the work force, as welfare benefits are, the refundable child tax credit could provide a bridge for families striving to enter the economic mainstream. It would substantially benefit hard-pressed single and married parents raising children. It could also help middle-income, employed parents struggling to afford high-quality child care. Moreover, because it is neutral toward family structure and mothers’ employment, it would not discourage the formation of two-parent families or of single-earner families in which one parent chooses to stay at home and care for the children.

A fully refundable Child Tax Credit, as recommended on a bipartisan basis 34 years ago, would end the negative treatment and penalties imposed upon babies and children in the following circumstances:

Having a mother who loses income during pregnancy, childbirth, and postpartum, so no longer qualifies for the full credit for their baby and the baby’s siblings.

Living through a natural disaster with an accompanying loss of household income

Experiencing the death of a parent.

Suffering as a victim of violence or abuse and a related loss of household income.

Dealing with a parent who suffers from an illness, such as cancer, or has a disability that reduces household income.

Having a parent serve as a caregiver for a child, their other parent, or other family member.

Living with a parent who loses a job and income, even on a temporary basis.

In all of these cases and others, babies and children are penalized for circumstances beyond their control, including tragedies and catastrophes.

The best solution would be to eliminate these “baby and child penalties” by making the Child Tax Credit fully refundable. However, if Congress is unwilling to pass the best possible version of the Child Tax Credit, it should – at the very least – fix the most harmful parts of the current law and H.R. 1.

At a Minimum, Congress Should Reduce Baby and Child Penalties

In lieu of full refundability for all children, the Senate should amend H.R. 1 during the floor amendment process (i.e., “vote-o-rama”) to ensure:

All children under age 6 receive the full refundable credit with no income floor.

Children who lose a parent due to death are no longer denied the full credit.

Children and families affected by natural disasters receive the full credit to aid in recovery for a period of time.

Children with laid-off parents are not punished with a smaller benefit.

Children of caregivers who experience reduced income to care for family are not excluded from the credit

The Child Tax Credit phases-in at 15% per child, as was included in last year’s Wyden-Smith bipartisan deal, so larger families are no longer penalized.

Address basic fairness and due process by allowing all U.S. citizen children to continue to receive the Child Tax Credit by striking the language requiring parent(s) Social Security numbers.

Expand the Child Tax Credit to 17-year-olds.

None of these are radical changes. Collectively, they would, at the very least, provide some mitigation of harm to those children most in need.

American voters overwhelmingly agree.

We already know the expanded Child Tax Credit works. In 2021, it cut child poverty nearly in half. It helped families make rent, buy food, and afford child care. And it did so without discouraging work or triggering fraud, just as the research predicted.

The American Family Act is the policy we need. But short of that, we must stop asking children to wait until politics catch up with morality.

Join the Conversation and Advocacy

Tell us: which plan reflects your values? What would it mean to truly make every child count?

Leave a comment. Share this post.

And if you agree that the Child Tax Credit should serve all our children:

Call your senators and House member and demand improvements to the Child Tax Credit

Subscribe to Kids Can’t Wait

Consider becoming an Ambassador for Children

Consider a donation to support the work of First Focus on Children to make children a greater priority in federal budgets and policies during our 20th Anniversary