What Kind of Nation Penalizes Its Poorest Children?

During Children’s Week, which starts today, we must demand better for kids from our politicians on issues such as the Child Tax Credit, Medicaid, CHIP, and SNAP.

On its face, the Child Tax Credit expansion in H.R. 1, the big, giant budget reconciliation bill, might appear to be progress. It raises the credit’s maximum value from $2,000 to $2,500 per child, which is a change aimed at helping some families with children keep pace with inflation since the 2017 Trump-era tax law.

But zoom out ever so slightly and the illusion fades. Tens of millions of children, who are most in need, are shortchanged by the bill.

H.R. 1 does not fix the most damaging flaws in the Child Tax Credit. It doesn’t make the credit fully refundable and leaves 1-in-3 children behind.

It also explicitly denies the credit to 4.5 million U.S. citizen children in mixed-status immigrant families. It erects new barriers while leaving intact old ones. It quietly, but decisively, shifts support away from the children who need it most – our nation’s poorest children – and redirects it to those better off.

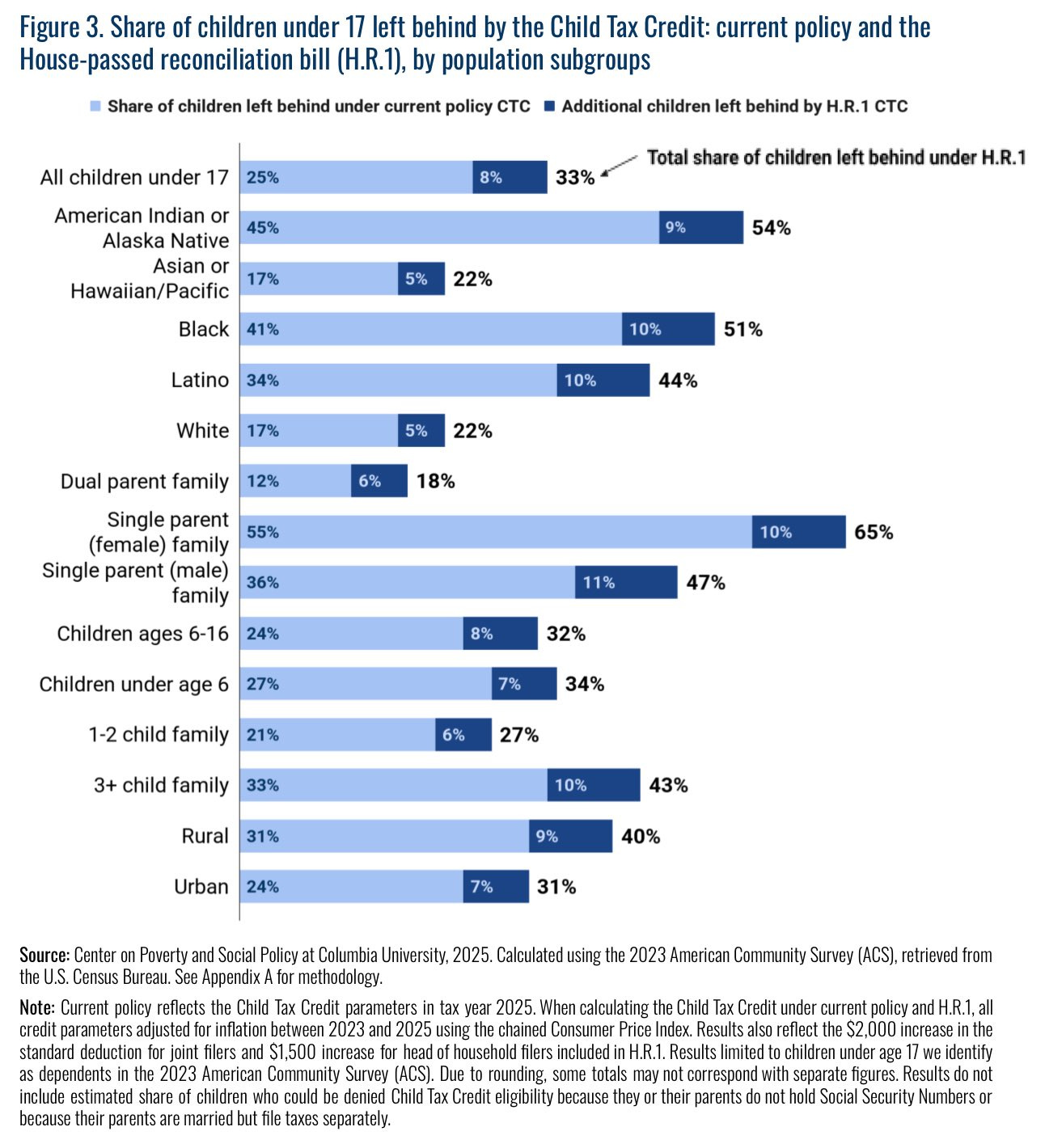

According to a new analysis by Columbia University’s Center on Poverty and Social Policy, a staggering 22 million – or 1-in 3-children in the United States under age 17 – will receive no or only a partial credit simply because their family income is too low.

Current law leaves 17 million children behind, but H.R. 1 increases that figure to an astounding 22 million. These children aren’t just statistics or policy abstractions. They are disproportionately babies and toddlers, children in single-parent households, kids living in rural areas, children of color, and children living in larger families.

Rather than addressing the injustice of income-based penalties that harm babies and children in federal tax law, H.R. 1 makes it far worse. Families need more help, not new barriers, thresholds, and red tape. While wealthier families will receive the full $500 increase in H.R. 1’s Child Tax Credit, lower-income children will receive only partial or no credit at all. Consequently, Trump’s big, ugly bill, significantly increases the disparity in income and life opportunities available to rich versus poor children.

At the core of this policy is the bizarre and tragic idea we must confront directly: that only some children are “deserving” of help. The very structure of the credit implies that if a child is born into the wrong ZIP code, or to a mother who lost income during pregnancy and childbirth, or to a family who are victims of a natural disaster, or to a parent who has died due to accident, illness, or violence, or to a parent who lost their job due to an economic recession or government tariffs, or to a family struggling with illness or caregiving responsibilities, those children are less worthy of support.

These children, who have greater and not fewer needs, are either subjected to a reduced credit or even worse – nothing at all.

If the credit were equally available to low-income kids, the child poverty rate would be cut by nearly half. That would be far better policy, as child poverty through policy that withdraws the Child Tax Credit negatively impacts every aspect of the lives of children: their health, education, nutrition, housing, safety, and well-being.

The National Academy of Sciences, Engineering, and Medicine (NASEM) estimates that child poverty is also costing society up to $1.1 trillion a year in “lost adult productivity, the increased costs of crime, and increased health expenditures.”

Policy that leads to increased child poverty is both a moral and an economic failure.

22 Million Children Left Behind and Why It Matters

The children left behind by H.R. 1 are not a statistical fluke. They are the very children public policy should be designed to protect.

The Columbia University analysis makes it clear: H.R. 1 disproportionately harms children of color, children in single-parent households, babies and young children under the age of six larger families, and children in rural areas. In other words, it punishes children not for what they’ve done, but for who they are and where they were born.

Consider these groups:

65% of children living with a single mother will be ineligible for the full credit.

More than half of Black children (51%) and over 44% of Latino children will be denied the full benefit.

One in three children under the age of six — those at the most critical developmental stages — are left out.

43% of children in families with 3 or more children receive only partial or no credt.

40% of children in rural communities are excluded from full support.

These are not accidental oversights. These are structural decisions. The income phase-in design of the Child Tax Credit says, in essence, that only if your parents earn enough do you qualify as fully deserving.

House leadership and the Trump Administration should explain which children they believe are “undeserving” and should be pushed back into poverty. Are they…

The children of parents with disabilities?

The siblings of children with disabilities, whose parents can only work part-time or quit to take care of their kids?

The children of stay-at-home mothers?

The children whose parents cannot afford child care and must work limited hours?

The children whose parents have had to quit to take care of their own frail and elderly parents?

The children of teenage mothers, including those who are victims of child trafficking, rape, incest, or failed contraception?

The children being cared for by grandparents or other relatives while parents are undergoing medical care or substance abuse treatment?

The children being cared for by grandparents or other relatives due to allegations of abuse or neglect by parents?

The children of parents who are incarcerated?

The children of parents who lost their jobs due to changes in the global economy, tariffs, automation, artificial intelligence (AI), etc.?

The children of farmers who lost their crops due to natural disasters or drought?

The children in families who are victims of other types of natural disasters, such as hurricanes, tornadoes, wildfires, or even earthquakes?

The children of parents who are in college or job training programs?

The children of women who leave abusive and violent relationships?

The children who lost a parent due to cancer, a heart attack, stroke, a car accident, etc. and thereby live in a household with reduced income?

The children who lost a parent due to service in the military or as a police officer or firefighter, and thereby live in a household with reduced income?

When the focus on legislation of importance to children shifts to the “deservingness” and work of parents, it is the children who are most negatively impacted but are somehow forgotten or treated as an afterthought.

These questions highlight how punishing children for these types of circumstances is irrational, unjust, and indefensible. There is simply no economic case or moral justification for denying a child the support they need simply because they live in a family struggling with illness, disability, low wages, caregiving responsibilities, or job loss.

The American people agree. By an 83-11% margin, a poll by Lake Research Partners in April finds that voters support a fully refundable Child Tax Credit “for all families with low incomes.”

And by a 74-11% margin, voters are even more likely to support making the Child Tax Credit fully refundable when told failure to do so punishes children for childbirth, natural disasters, job loss, caregiving, or the death of a parent.

This is why the language of being “left behind” is so apt. These children aren’t failing to qualify because of a fair system: they’re being deliberately excluded by design choices that reward wealth and penalize children most in need.

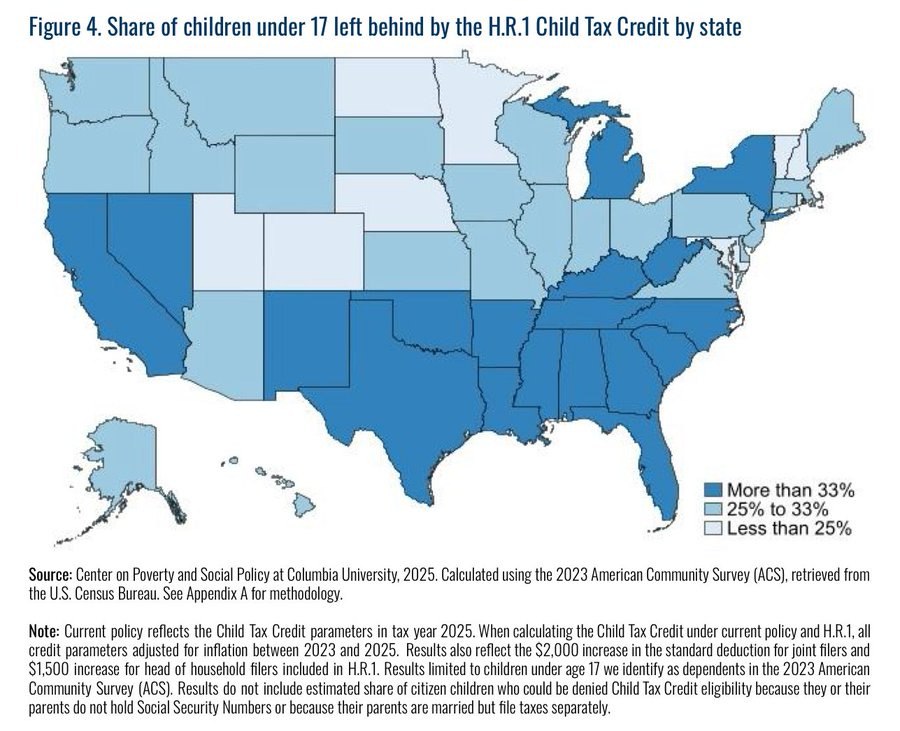

And geography matters too. H.R. 1 creates deep regional disparities. In 18 states, most of them in the South, more than one in three children are denied the full credit.

In Mississippi, 45% of children are left behind. In New Mexico, it’s 44%. In Louisiana, 43% of children do not qualify for the full credit. These are states already grappling with high child poverty rates and poor child outcomes.

Cutting off support to low-income children is not just counterproductive — it’s a form of neglect.

Ironically, the policy is being spearheaded by House leaders like Speaker Mike Johnson (R-LA), Majority Leader Steve Scalise (R-LA), Conference Chair McClain (R-MI), and Policy Chair Pfluger (R-TX) despite the fact that the policy disproportionately shortchanges the children and families in their own states.

Citizenship Should Count: The 4.5 Million Children Excluded by Status

Among the most unjust provisions in H.R. 1 is one that cuts an estimated 4.5 million U.S. citizen children off the Child Tax Credit entirely – not because of anything they’ve done, but because one or both of their parents do not have a Social Security Number. These children live in so-called mixed-status immigrant households, where their caregivers may use Individual Taxpayer Identification Numbers (ITINs) but still pay federal taxes.

This exclusion is as cruel as it is senseless. These children are citizens. They go to school in our communities, rely on our health care systems, and will one day be the workers, leaders, and taxpayers of our economy.

Children are the ones that qualify for the Child Tax Credit – not parents. Yet H.R. 1 treats them as less deserving, denying them the same support granted to peers born into identical circumstances except for one factor: their parents' immigration status.

This is no small oversight. It’s a direct attack on equal treatment under the law. It’s a violation of basic fairness and a betrayal of our national values.

The real question is not whether a parent has a Social Security number. The question is whether we believe a U.S. citizen child should be treated as a second-class citizen and denied help because of something related to their parents’ or caregivers’ immigration status.

There is no serious policy rationale for this exclusion. It’s punitive, divisive, and cruel – and it must be reversed. No child should be held hostage to the status of their parents.

The Triple Penalty on Babies and Moms

Furthermore, if there is any one group of children who deserve extra protection under the law, it’s newborns. Babies arrive with unique vulnerabilities and bring new expenses for families. Public policy should rise to meet that moment and offer support, not punishment.

It is, after all, called for by “pronatalists” in the Trump Administration, including Vice President JD Vance himself.

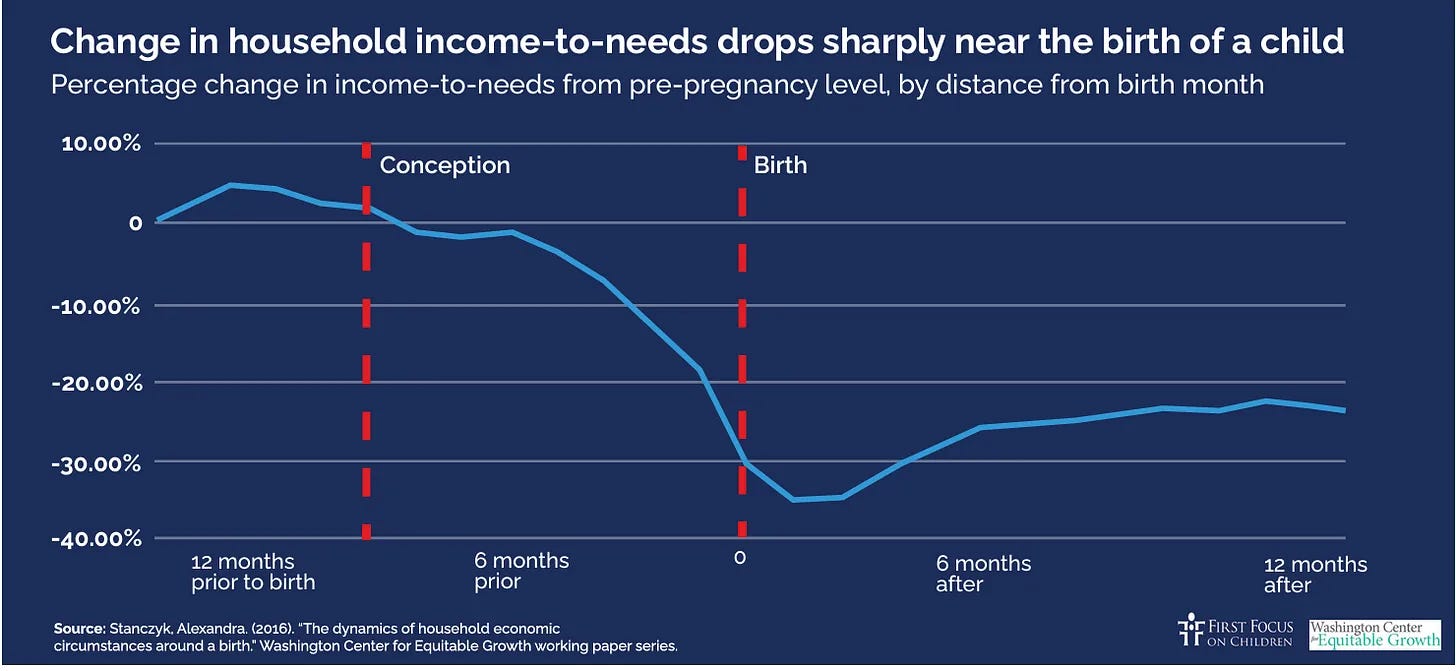

But under H.R. 1, despite being a big, gigantic tax bill, lawmakers in the House chose to do the opposite. The policy adopted in H.R. 1 penalizes the birth of a child by shortchanging the baby, the mom, and other children, who also lose or have their credits reduced due to the loss or decline in income of mothers related to pregnancy and childbirth.

For these families, the birth of a baby can bring a “triple-whammy” of financial strain:

Household expenses spike, with costs for diapers, food, medical care, and child care

Income drops sharply, often due to unpaid leave, physician-advised bed rest, birth complications, or caregiving demands

The Child Tax Credit is reduced or eliminated, precisely because that income has dropped

Research by economist Alexandra Stanczyk has shown that family income-to-needs ratios drop by nearly 40% from conception through the month of birth and remain depressed for a full year afterward.

Rather than supporting moms and babies, under current law and under H.R. 1, these families often receive less from the Child Tax Credit, not more.

The injustice deepens when you consider the broader context. The families shortchanged are often younger families early in their careers and disproportionately low-wage workers just seeking to start a family. Instead of recognizing the enormous social and economic value of caregiving and early parenting, the tax code treats their circumstances as failures to be penalized: a full-blown penalty against babies and motherhood.

Sen. James Lankford (R-OK) has said:

Federal benefits available to moms should be available to all moms.

H.R. 1 fails that simple test.

A Child Tax Credit that only works for middle- and upper-income mothers and babies is a tax policy that lacks morality.

If we are serious about valuing life, about affirming families, about truly being pro-child, then we must be serious about meeting families where they are, not where we wish they were. That means recognizing:

That families experience hardship, and still deserve help.

That caregiving is labor, and should be valued.

That every child, regardless of income, geography, race, or immigration status, is inherently worthy of support.

We cannot claim to be a family-friendly nation while penalizing the very act of having a child. Families with children need the benefit of a full Child Tax Credit, particularly low-income families, and not motherhood medals, as some have proposed.

…this is not a mere transfer of wealth from poor to rich; in many ways, it’s also a transfer of wealth from young to old. That is, many of the ‘pay-fors’ in this bill disproportionately hurt babies and children.

The 2021 Child Tax Credit: A Vision Worth Reviving

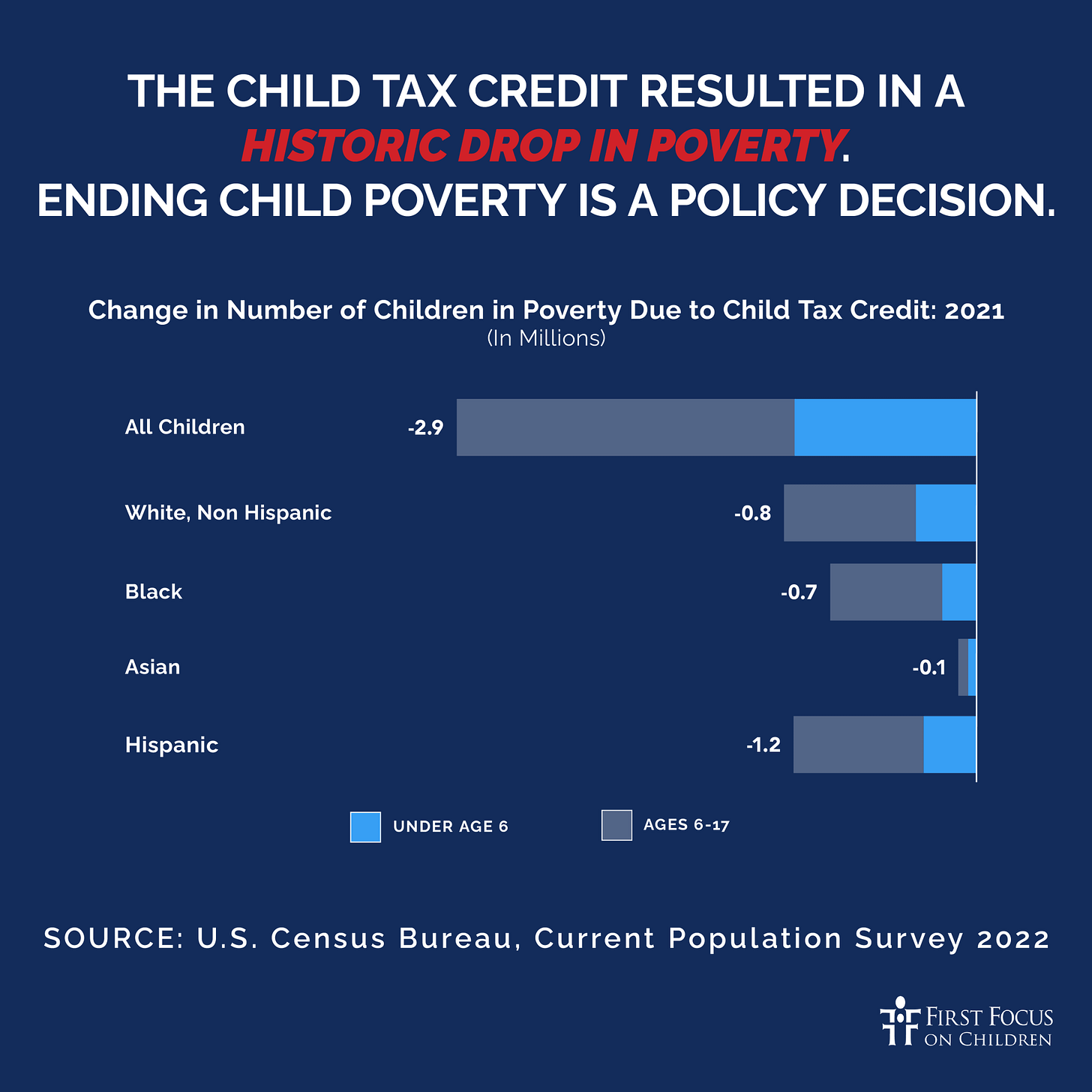

If we want to see what it looks like when public policy truly supports children, we need to look no further than 2021.

As part of the American Rescue Plan Act, Congress temporarily transformed the Child Tax Credit into what it always should have been: a tool for equity, stability, and opportunity for all children and their families. For one brief year, the credit was:

Fully refundable, meaning the poorest families received the full amount.

Expanded to include 17-year-olds, previously left out.

Increased to $3,600 for children under age 6 and $3,000 for all other U.S. citizen children.

Delivered monthly, providing families with predictable support to cover rent, food, diapers, and bills.

And the results were stunning. According to the U.S. Census Bureau, the enhanced Child Tax Credit lifted nearly 3 million children out of poverty and contributed to a 46% drop in the child poverty rate – all during a global pandemic and economic recession.

The reduction in child poverty led to real-life improvements in health, housing, nutrition, and financial security for families. Food insecurity declined. Eviction risks dropped. Stress levels among parents fell. Children had what they needed to thrive.

This brief window of economic justice for children and families has given us a roadmap. We saw what’s possible when we reject the false, cruel logic of deservingness being imposed upon children. We saw what happens when every child counts.

Unfortunately, the change was temporary and expired at the close of 2021. Since then, the rate of child poverty has surged from a historic low of 5.2% and to 13.7% in 2023.

Instead of following the proven success of the 2021 model, H.R. 1 reverts to an ideology that penalizes families for being poor, being rural, being a baby, being a victim of a natural disaster, or being a child of an immigrant.

The question before us is not whether the country can afford to invest in our children and grandchildren. It’s whether we choose to, instead, shift enormous windfalls and benefits to older, wealthier benefactors of tax cuts.

A Nation’s Values Revealed

Tax policy may seem like dry economics, but it reflects, in dollars and cents, what a nation truly values and who it’s willing to leave behind.

H.R. 1 makes the values of its drafters painfully clear: corporations and the wealthy matter far more than those born into struggle. As highlighted by Professor Scott Galloway, the juxtaposition in H.R. 1 of raising the estate tax exemption to $15 million per person, which would allow wealthy couples pass on $30 million to their heirs tax-free, while low-income children are being denied the Child Tax Credit, is stark.

My First Focus on Children colleague Lily Klam and Carl Davis at the Institute on Taxation and Economic Policy (ITEP) have also detailed how the Educational Choice for Children Act (ECCA) provisions that were added to H.R. 1 in the House would further enrich the wealthy and organizations giving out private K-12 school vouchers.

ITEP refers to ECCA as “shelter skelter,” as it will provide a tax shelter “to wealthy families’ interest[ed] in tax avoidance and personal profit as a means of bolstering private schools at the expense of public budgets,” according to Davis’s analysis.

In the name of children and rather than improving the Child Tax Credit for actual children in need, H.R. 1 creates an elaborate tax scheme to ensure rich “donors” and Scholarship Granting Organizations (SCOs) will reap enormous profits from this scheme at taxpayer expense.

To compound the harm, H.R. 1 also threatens low-income children and families with over $1 trillion in budget cuts to Medicaid, the Children’s Health Insurance Program (CHIP), the Affordable Care Act (ACA), and the Supplemental Nutrition Assistance Program (SNAP). This is yet another quadruple-threat of horrible policy and harm to children embedded in H.R. 1.

While our lawmakers are choosing to enrich the wealthy, they are simultaneously pushing low-income children deeper into poverty and adding trillions of dollars of debt to the burden that must be carried by the next generation.

A Call to Action: Fix the Credit and Center Children

This disastrous consequence for children is not inevitable. The Senate can and must do better.

Concerning the Child Tax Credit, the Senate should:

Restore full refundability so that every child is eligible, no matter how low their family’s income.

Reject the exclusion of mixed-status families. U.S. citizen children should not be punished for their parents’ immigration status.

Reinstate monthly payments, providing stability when families need it most.

The Senate should also reject the over $1 trillion in cuts to Medicaid, CHIP, ACA, and SNAP.

When the Senate takes up and debates H.R. 1 and the Child Tax Credit in the next few weeks, it’s defining who counts in America and who does not. It will tell us who’s for children and who’s just kidding.

Now, during Children’s Week (which begins today and runs through June 14), we urge parents, caregivers, child advocates, and young people themselves to demand that lawmakers do better by kids and our future.

If you would like to help ensure that children and their needs, concerns, and best interests are no longer ignored by policymakers, please consider joining us as an “Ambassador for Children and/or becoming a paid subscriber to this newsletter to help us continue our work on behalf of children.