The Child Tax Credit is critically important to 60+ million children and their families nationwide. Unfortunately, it has a major flaw: it provides the least support to children in families who are most in need – children living in poverty.

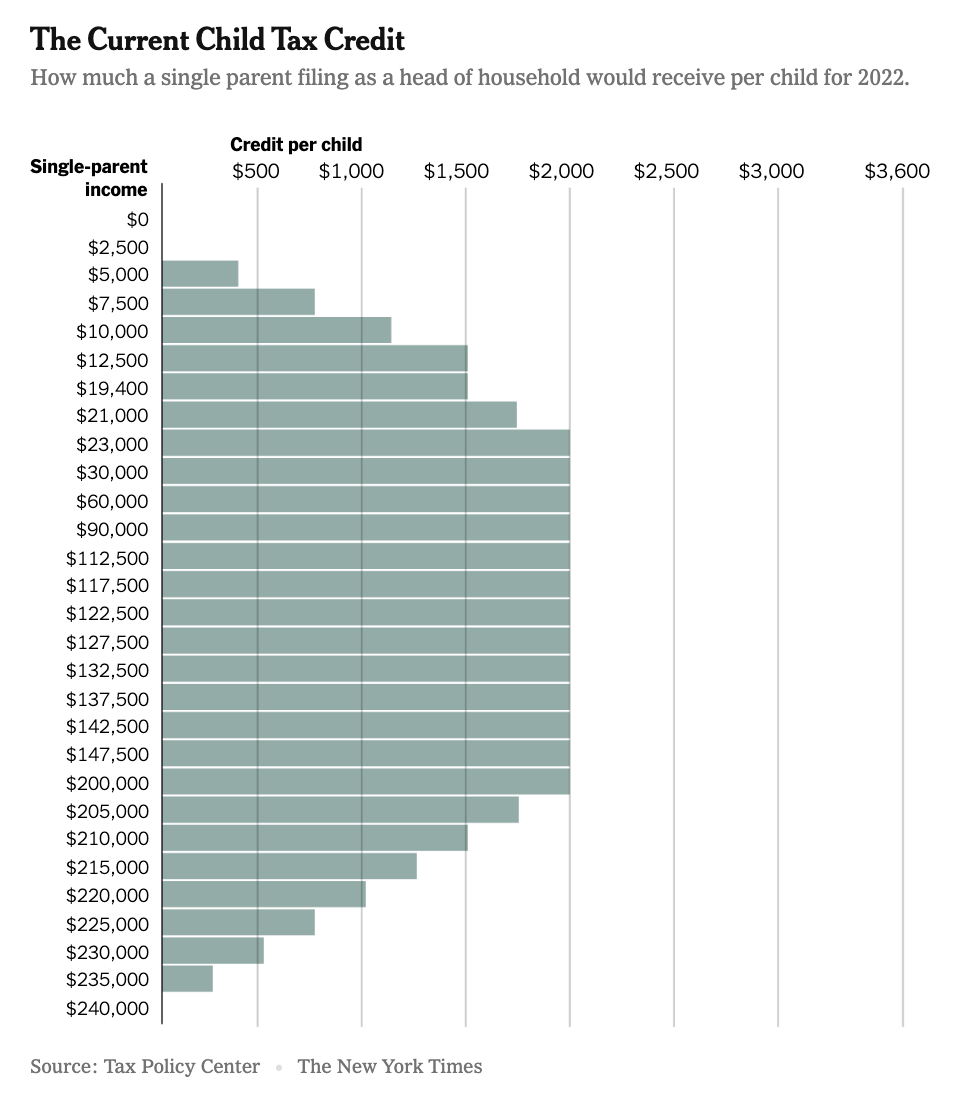

As the chart shows, the lowest-income children in the U.S. receive either partial or no credit because their parents make too little to qualify for the full Child Tax Credit. In effect, federal policy is promoting child poverty.

Columbia University’s Center on Poverty and Social Policy (CPSP) estimates that 18 million children are “left behind” and denied the full Child Tax Credit because their parents make too little.

This is nonsensical.

In 2019, the National Academy for Sciences, Engineering, and Medicine (NASEM) issued a landmark report, A Roadmap to Reducing Child Poverty, offering policy options that could cut child poverty in half. NASEM’s national experts found that child poverty negatively impacts just about every aspect of the lives of children and costs the nation up to $1.1 trillion annually. Consequently, NASEM recommended making improvements to the Child Tax Credit that would expand the value of the credit from $2,000 to $3,600 for children under the age of 6 and $3,000 for all other children and make it fully refundable.

Building upon the expert panel’s recommendation and legislation by Rep. Rosa DeLauro (D-CT) and Sen. Sherrod Brown (D-OH), Congress passed and President Joe Biden signed into law the American Rescue Plan Act (ARPA), which increased the value of the Child Tax Credit and made it fully refundable for 2021.

Consequently, an estimated 60 million children and their families benefitted, child poverty was slashed, food and housing hardship was reduced, and child abuse and neglect decreased.

Unfortunately, Sen. Joe Manchin (then D-WV and now I-WV) joined Senate Republicans to oppose extending the improved Child Tax Credit and allowed it to expire at the close of the year. As a result, the U.S. Census Bureau estimated that child poverty more than doubled from a record low of 5.2% in 2021 to 12.4% in 2022.

Opponents Ignore the Negative Consequences of Their Policies on Children

The purpose and focus of the Child Tax Credit is in its name: CHILD.

Sadly, when it comes to child policy, children are often the afterthought, even when the purpose of the program is children.

Consequently, when the improved Child Tax Credit expired, some conservatives were focused primarily on the adults and were pleased to see the expanded credits expire, as they judge low-income parents to be “undeserving.”

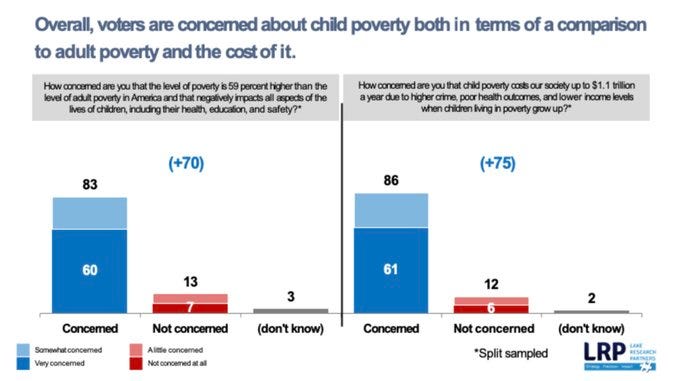

The opponents of an improved Child Tax Credit effectively supported tax increases on families with children (anywhere from $1,000 to $3,600 per child when the 2021 Child Tax Credit enhancements expired) and seem unconcerned about the negative consequences to children of poverty or that child poverty costs the nation up to $1.1 trillion annually.

When conservatives like Matt Weidinger, Scott Winship and Kevin Corinth of the American Enterprise Institute (AEI) discuss the Child Tax Credit, they typically ignore the fact that their policy positions would continue to exclude low-income children from the Child Tax Credit and lead to higher rates of child poverty.

A CPSP study finds that the kids “left behind” and denied the full Child Tax Credit are disproportionately:

children under the age of 6 (40% receive only partial or no credit);

Black and Hispanic children;

children in single parent households (“70% of children in families headed by single parents who are female do not receive the full credit”); and,

children in rural communities.

The children who need the Child Tax Credit the most get the least.

In sharp contrast, over 30 years ago, a bipartisan National Commission on Children report, created under President Ronald Reagan and presented to President George H.W. Bush, recommended the establishment of the Child Tax Credit for all children and families.

As the 1991 bipartisan National Commission on Children explained:

The United States is the only Western industrialized nation that does not have a child allowance policy or some other universal, public benefit for families raising children…. Other nations that have adopted child allowance policies regard such subsidies as an investment in their children’s health and development and in their nation’s future strength and productivity.

The National Commission on Children’s report, Beyond Rhetoric: A New American Agenda for Children and Families, recommended that the Child Tax Credit go to all families with children and not be withheld in whole or in part from its poorest children and families.

The Commission proposed:

Because it would assist all families with children, the refundable child tax credit would not be a relief payment, nor would it categorize children according to their “welfare” or “nonwelfare” status. In addition, because it would not be lost when parents enter the work force, as welfare benefits are, the refundable child tax credit could provide a bridge for families striving to enter the economic mainstream. It would substantially benefit hard-pressed single and married parents raising children. It could also help middle-income, employed parents struggling to afford high-quality child care. Moreover, because it is neutral toward family structure and mothers’ employment, it would not discourage the formation of two-parent families or of single-earner families in which one parent chooses to stay at home and care for the children.

Conservative members on the Commission were very supportive of creating a fully refundable Child Tax Credit. This is because the Commission’s recommendations were focused on what should always be a bipartisan objective: the best interests and well-being of children.

In fact, the American public overwhelmingly agrees that this should be the fundamental premise of public policy with respect to children.

Moreover, the bipartisan panel of Commission experts recognized the importance of parents, that parenting is hard work and expensive, and that creating a fully refundable Child Tax Credit would have positive work incentives and should not punish parents who choose to “stay at home and care for the children.”

The National Commission on Children also focused on the positive impact that lifting millions of kids out of poverty would have on both the children themselves and on society.

The American people share these concerns.

In an important recognition of the problems created by the CTC’s “baby and child penalties,” Rep. Jason Smith (R-MO) and Sen. Ron Wyden (D-OR) introduced H.R. 7024, the Tax Relief for American Families and Workers Act of 2024. That bill passed the House in January on a bipartisan basis by an overwhelming margin of 357-70.

It is ironic and tragic that some Senate Republicans are rejecting this approach, and instead, support imposing “baby and child penalties” on an estimated 18 million children in low-income families who need it the most.

Many Conservatives Support an Improved Child Tax Credit

All children should have the opportunity to achieve their dreams and to live up to their God-given potential.

While Weidinger, Winship, and Corinth express their opposition to an improved Child Tax Credit, many Republicans or conservatives do not agree with their positions, including some of their colleagues at AEI.

As the divergence between the bipartisan National Commission on Children recommendation and these three men at AEI exemplifies, conservatives do not always agree on what are the best policies when to comes to children and family issues.

And thank goodness.

In a Feb. 27th letter signed by over 25 “leaders across the conservative movement,” the co-authors express strong support for improving the Child Tax Credit and declare that the bipartisan H.R. 7024 is “pro-child and pro-parent.”

At First Focus on Children, we would agree with these sentiments and the need to eliminate “baby and child penalties” in the Child Tax Credit.

First, there are Republicans who “value families” and think public policy has a role to play in supporting family formation and ensuring the well-being of mothers and children. As Abby McCloskey writes in a brilliant piece in Politico:

There has been far too little serious thinking about policies and ideas related to supporting motherhood and family policy on the right. Part of this shortage stems from a conservative desire to limit government overreach, but it has created gaping holes in the safety net, particularly for mothers and children.

Abby McCloskey and I chat about the Convergence project’s report In This Together: A Cross-Partisan Action Plan to Support Families with Young Children in America and how we found there is common ground between progressive and conservative groups on children’s policy issues in Episode #14, “Supporting Children and Families is a Bipartisan Effort,” of the Speaking of Kids podcast.

When it comes to tax policy, McCloskey, who co-signed the Feb. 27th letter, adds:

The most impoverished age group of U.S. citizens are those under the age of five. A monthly child tax credit that’s refundable and tightly targeted by income could help to eradicate child poverty. Those reforms should be paired with an expansion of the Earned Income Tax Credit, which boosts the income of low-wage workers and has a long history of encouraging work, especially for single mothers. Some parents would like to stay home or scale back work hours, and an improved CTC and EITC system could create more financial flexibility and options for these families as well.

Her focus on the needs and well-being of children is much appreciated.

McCloskey makes a compelling conservative case for “striving to make America the best place to be a mother and raise kids” with an agenda that includes family leave, child care, improvements to the Child Tax Credit and Earned Income Tax Credit, maternal health, and school safety.

Likewise, the Niskanen Center’s Robert Orr makes the case for targeted investments on young children and families. Orr highlights the struggles of younger families, who are early in their earning trajectory, to have children, and consequently, that young children have the highest rates of child poverty. Orr explains:

While renewing the expanded CTC with full-refundability for all ages remains the first-best policy, if that approach can’t secure sufficient support in Congress, enacting a child allowance for children ages 6 and younger is the next best option…. Not only would doing so deliver a greater poverty impact, but concerns about work incentives would also be lessened given the special and temporary obligations of parents with infant children.

Source: Robert Orr, “Why Child Tax Credit expansions should prioritize younger children,” Niskanen Center.

Second, parents deeply appreciate the Child Tax Credit and recognize the difficulty and high costs associated with raising a child. In a February 2024 National Parents Union poll, the #1 issue that parents want the federal government to act on would be to “expand the Child Tax Credit” (87-9%). In a country as politically divided as ours, this is about as close to consensus as it gets.

As the poll demonstrates, the vast majority of Republican parents support expanding the Child Tax Credit and it shows how some conservative think tanks are out-of-touch with the needs and desires of parents and children.

Third, religious leaders, who are more often conservative on social policy but concerned about issues related to poverty, hunger, and homelessness, are often supportive of improving child and family policies. Some members of this community have moved beyond a focus on “culture wars” to embrace a broader agenda that includes lifting children out of poverty and tackling issues like child hunger, homelessness, and child abuse.

The Feb. 27th letter, which includes a number of conservative religious leaders, explains that H.R. 7024 especially helps “younger, larger families” by “eliminating the penalty for having more than one child.” The co-authors add:

As conservatives, we believe that every child is a gift from the Creator, and that the family forms the backbone of a flourishing society.

As a reminder, an improved Child Tax Credit that reduces child poverty helps improve every aspect of the lives of children. It also has a potentially enormous fiscal payoff to our country.

Fourth, related to this, many in the pro-life community have expressed strong support for expanding the Child Tax Credit. Georgetown University’s Kathleen Bonnette writes:

We know that poverty increases abortion rates, and restrictions on abortion run the risk of increasing child poverty if they are not accompanied by social support measures. Unfortunately, the pro-life movement has left itself open to the accusation that it is only pro-birth, and some pro-life elected officials seem oblivious to the ways their other policies can harm children and families.

In their support for an improved Child Tax Credit, the co-authors of the Feb. 27th letter add:

The bill before you is also decidedly pro-life. Many of us work every day alongside expectant mothers who desire to birth and parent their child. So often, the one thing needed to take that step of courage is a glimmer of hope that there is a way to provide for that child. One of the most financially challenging times in a family's development is pregnancy and the first few months of a baby's life. This period often involves necessary income loss from a budget that is already stretched. The CTC provisions in question provide a common-sense way to provide targeted pro-life tax relief to point of greatest need.

For a mother trying to have a baby, their income drops, on average, 34% due to a variety of factors, including complications related to pregnancy, child birth, and postpartum care, as well as the lack of paid leave and affordable child care in this country.

At the very time when moms are receiving reduced income due to having a baby and rising costs, current federal policy often penalizes these babies and families by slashing their Child Tax Credit because they now make too little to qualify for the full credit.

This situation fails what we are calling the “Lankford Test,” which is based on Sen. James Lankford’s (R-OK) statement that federal policy should “ensure the federal government treats all moms the same, no matter how small or young her baby is.”

A fully refundable Child Tax Credit would treat all moms and babies the same. The current Child Tax Credit does not, and thus, fails the “Lankford Test.”

H.R. 7024 would help mitigate (but not eliminate) these “baby and child penalties” but would be an important step.

Sadly, the AEI trio even oppose this modest “pro-life, pro-child, and pro-family” measure. Instead, they are demanding the continued imposition of “baby and child penalties” on families in “greatest need.”

Fifth, a growing number of conservative analysts, including Ramesh Ponnuru, editor of the National Review, are calling for the Republican Party to adopt policy changes to address declining birth rates by helping families bear the “financial sacrifices needed to raise the next generation of taxpayers.”

Ponnuru points to a variety of pro-family policy changes for conservatives to adopt, which includes expanding the Child Tax Credit to “reduce payroll-tax liabilities even for people who do not pay income tax.” He points out this would help reduce the “opportunity costs” of raising a child and “large implicit tax on parents” related to intergenerational payroll taxes paid to support Medicare and Social Security.

The low earner who pays payroll taxes and raises a child is contributing more to the future of Social Security and Medicare than the low earner who pays payroll taxes but does not raise a child.

Ponnuru adds that even if expanding the Child Tax Credit and other pro-family policies do not create an “economic incentive so great that it made adults want to have more children,” it would, at least, “make it easier for them to have the children they already want.”

Serina Sigillito, editor of Public Discourse, also makes the conservative case for helping families overcome financial burdens to have children. She argues public policy should not penalize a parent for choosing to have additional children and care for their child at home, as the current Child Tax Credit does. Consequently, Sigillito calls for making the Child Tax Credit fully refundable, as was proposed by Sen. Mitt Romney (R-UT) in 2021. She explains:

Government programs should aim at supporting parents while respecting their autonomy and prudential judgment, enabling them to choose the right arrangement for their family. It’s time for the GOP to get serious about funding programs that accomplish those aims.

Again, this is also what the bipartisan National Commission on Children proposed back in 1991.

Sixth, there are many conservatives who support cutting taxes on corporations and business, but they recognize that such tax proposals need to be coupled with tax relief to families in order to make them politically viable. Throughout its history, Child Tax Credit changes have always been accompanied by other changes to the tax code, such as an extension of the R&D tax credit in H.R. 7024.

Centering Children in the Child Tax Credit Debate

As we consider changes to the Child Tax Credit, such as eliminating “baby and child penalties,” it is important to center children in the conversation.

As the improved Child Tax Credit proved, a fully refundable credit played a significant role in cutting child poverty to an all-time low of 5.2% in 2021. When it expired at the close of that year, child poverty more than doubled to 12.4% in 2022.

Children who grow up in poverty are more likely to experience adverse outcomes in health, education, nutrition, housing security, and overall well-being. By reducing child poverty, a fully refundable Child Tax Credit would contribute to improved health outcomes, better educational achievements, and greater social stability. These benefits extend to society as a whole, as healthier and better-educated children grow up to be more productive and engaged citizens. As mentioned earlier, NASEM estimates that child poverty costs society up to $1.1 trillion annually.

In addition to the health, education, nutrition, and housing benefits of lifting children out of poverty, studies have found a direct correlation between child poverty and higher rates of child abuse and neglect.

Financial hardships increase parental stress and limit access to resources that support healthy family dynamics. By alleviating poverty, a fully refundable CTC reduces these stressors, creating a safer environment for children. For instance, research published in the Journal of the American Medical Association (JAMA) indicates that reducing child poverty through financial support programs leads to a significant decline in child abuse cases.

If improving the Child Tax Credit did nothing other than reducing child abuse rates, it would be well worth it.

Opponents of an improved Child Tax Credit cannot possibly explain how increased rates of child poverty and resulting poor outcomes, including higher rates of child abuse, are good for children and our nation’s future. Consequently, they desperately try to change the subject. We should not allow them to shift the focus away from kids and their best interests. Children are at the heart of this debate.

Conclusion

It is clear that the current structure of the Child Tax Credit fails to support those children and families who need it most. By not making the Child Tax Credit fully refundable, we perpetuate a cycle of poverty that has long-term negative impacts on children's health, education, and overall well-being.

The historical and bipartisan support for an improved Child Tax Credit shows that this is not a partisan issue but a moral imperative. We must prioritize our children in policy discussions, ensuring they have the support needed to thrive, flourish, and reach their full potential.

Investing in our children through a fully refundable Child Tax Credit is not only the right thing to do but also a smart economic decision that will benefit society as a whole. It is time to break down the barriers and penalties that keep our children in poverty and commit to a future where all children have the opportunity to succeed.

As a first step, the Senate should take up and pass H.R. 7024, the Tax Relief for American Families and Workers Act of 2024. For the benefit of millions of children and their families, we urge Senate Majority Leader Chuck Schumer (D-NY) to schedule the vote as soon as possible.

If you would like to help ensure that children and their needs, concerns, and best interests are no longer ignored by policymakers, please join First Focus Campaign for Children as an “Ambassador for Children” or please consider becoming a paid subscriber to help us continue our work. We do not have dedicated financial support for this work and rely on readers like yourself to support it. Thank you for your consideration.