In the wake of the expiration of the improved Child Tax Credit at the end of 2021, it was not uncommon to hear predictions of its demise. Although my friends and colleagues would likely characterize me as a pessimist when it comes to the probability that lawmakers will do right by our children, I am highly confident that some version of the improved Child Tax Credit will be passed into law by Congress either this year, next year, or by 2025.

First, the evidence is overwhelming that an extension of the Child Tax Credit is both a moral and economic imperative for our children and their future. Furthermore, I will make the case that the politics of the issue are changing and will make some form of its extension inevitable.

Background on the Improved Child Tax Credit

As background, the improved Child Tax Credit, which was included as part of the American Rescue Plan Act (ARPA) that passed in 2021, increased the Child Tax Credit from $2,000 to $3,600 for children under the age of 6 and to $3,000 for all other children, expanded the credit to 17-year-olds who were previously denied the credit, and made the credit fully refundable to all qualifying children on a monthly basis. Unfortunately, ARPA’s provision was temporary and expired at the close of 2021.

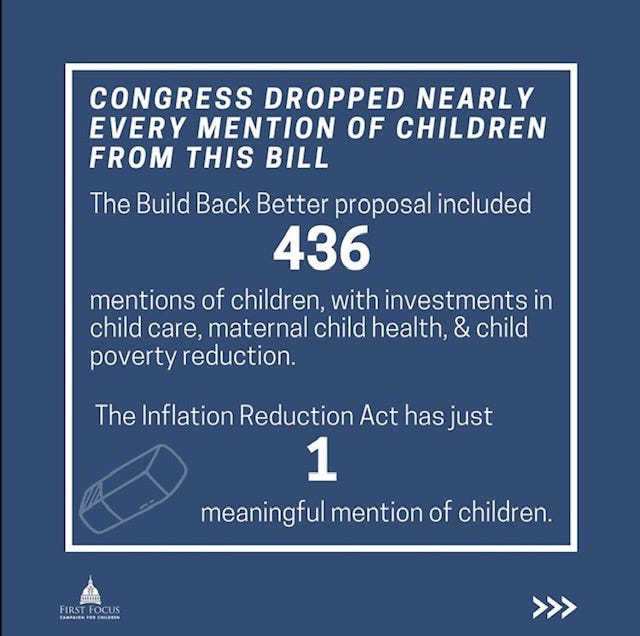

Democrats in the House of Representatives tried to prevent its expiration and passed the Build Back Better Act (BBBA) to extend the improved Child Tax Credit and other important issues of importance to children, including child care, early childhood, paid family leave, child nutrition, and child health. There were 436 references to children in BBBA, which would have been the most significant legislation of importance to children to be passed in decades.

Unfortunately, at the urging of Sen. Joe Manchin (D-WV), kids were stripped out and what remained was just one significant reference to children in the Senate-passed Inflation Reduction Act (IRA).

Let me repeat…436 to just 1.

For the 60+ million children and their families who benefitted from the improved Child Tax Credit in 2021, the consequences of its lapse have been devastating.

With its expiration, families with children received a tax increase of anywhere from $1,000 to $3,600 per child. Families had used this funding for household and children’s essential needs, including food, clothing, housing, and child care, with little to no effect on employment or labor supply.

Reasons Why Congress Must and Will Extend the Improved Child Tax Credit

Earlier this week, the U.S. Census Bureau released a report showing that the child poverty rate more than doubled from 4 million in 2021 to 9 million in 2022. As a result, the child poverty rate rose from 5.2% to 12.4% with the expiration of the improved Child Tax Credit cited as the biggest reason for this increase.

Source: Matt Bruenig, “Who Are the Poor in 2021 and 2022,” People’s Policy Project

As Washington Post columnist Catherine Rampell writes:

For the most part, these kids didn’t become poor because the economy is lousy, or their parents were fired, or they were newly orphaned. Most fell below the poverty threshold because, as a country, we chose to make them poor. Specifically, we chose to make them poor again, by snatching a short-lived safety-net program away.

In short, child poverty is a policy choice.

Under current law, as Columbia University’s Center on Poverty and Social Policy finds, over one-fourth of our nation’s children, or 18 million children, receive just a partial or no benefit from the Child Tax Credit because their parents make too little money.

Let me repeat…we punish children because their parents make too little.

Therefore, our tax code punishes children because their parents are poor, disabled, have lost their jobs, are at home caregiving for children or parents who are elderly or disabled, or cannot find employment that pays them adequately. For example, the minimum wage has not been increased since 2009.

Unless harming children is a goal, this policy makes no sense. If the Child Tax Credit were to no longer discriminate against low-income children, there would be 3 million fewer children living in poverty. This is the equivalent of filling the stadium of the 2023 NBA Championship Denver Nuggets to capacity 152 times.

This is untenable and cannot stand. Therefore, here are the reasons why I believe that Congress will take action to expand and improve the Child Tax Credit this year, next year, or at the latest, in 2025.

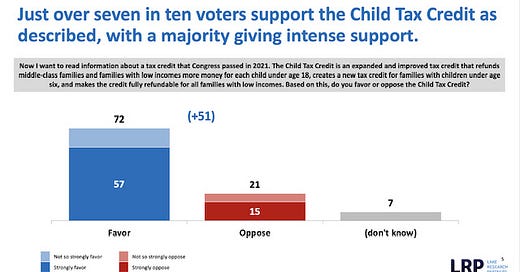

1. Voters Overwhelmingly Support Extending the Improved Child Tax Credit: Although there certainly are some voices, such as the Wall Street Journal editorial board, that celebrate rising child poverty, most people do not. In fact, in a May 2022 poll by Lake Research Partners, voters overwhelmingly said the nation is spending too little rather than too much on “reducing child poverty” (66-10%).

Therefore, it should be no surprise that the fully refundable Child Tax Credit is far more important to children and parents than the extremist anti-vax and book ban agendas that some are promoting.

In fact, according to the Lake Research Partners poll, voters favored extending the improved Child Tax Credit by an overwhelming and bipartisan margin (72-21% overall, including 90-7% among Democrats, 62-22% among Independents, 55-37% among Republicans, and 77-18% among parents).

The American people understand that children are not a partisan issue and that their well-being transcends partisan lines. It is something the vast majority of us can agree on.

2. The Child Tax Credit Improves Child Well-Being and Benefits Society: The central and unifying truth is that the Child Tax Credit is an investment in our nation’s most precious resource – our children. Our new Child Investment Research Hub includes a wealth of research that shows investing in children improves their well-being, their future, and makes possible the kind of society we should aspire to build.

The National Academy of Sciences, Engineering, and Medicine (NASEM) estimates that child poverty is costing our nation up to $1.1 trillion annually, “based on the estimated value of reduced adult productivity, increased costs of crime, and health expenditures associated with children growing up in poor families.”

An overwhelming majority of voters expressed concern (86% concerned and 61% very concerned, to just 12% not concerned) when presented with this data. It seems that the Wall Street Journal editorial board is in the small minority and that, in sharp contrast, the American people want action.

3. Research Demonstrates Investing in Children Is Cost Effective: Through an extensive study of evidence from cash and near-cash transfers, Irwin Garfinkel and associates find that the provisions of the improved Child Tax Credit cost around $100 billion annually but would “generate social benefits of $929 billion per year.” This research builds on 21 other studies that, with just one exception, find enormous benefits to increasing cash assistance to families with children, particularly for low-income families.

As the authors explain, “making the Child Tax Credit fully refundable and increasing its generosity is a remarkably good investment.”

4. Evidence Shows Passage of the Child Tax Credit in 2021 Worked: The impact of the improved Child Tax Credit in 2021 was transformative to children and families. Beyond the significant reduction in child poverty for millions of children, which improves just about every aspect of the lives of children, the improved Child Tax Credit also benefited nearly 60 million additional children across the country.

In an analysis of weekly data from the U.S. Census Bureau’s Household Pulse survey, the University of Michigan’s Patrick Cooney and H. Luke Shaefer found that various indicators of material hardship and financial stability improved in 2021 and reversed in 2022.

5. Reducing Financial Hardship Diminishes Incidences of Child Abuse: Opposition to child abuse and neglect is an issue that transcends political partisanship.

In a study by Lindsey Rose Bullinger and Angela Boy published in the Journal of the American Medical Association (JAMA), they found an association between enhanced Child Tax Credit payments and an “immediate reduction in child abuse and neglect-related emergency department visits in the days following disbursement of the Child Tax credit payments….”

As they conclude, “This study adds to the growing evidence that antipoverty policy is effective at reducing child abuse and neglect.” We should do everything in our ability to reduce child abuse and harm to children.

6. Democratic Policymakers Overwhelmingly Support Extension of the Child Tax Credit: President Biden put an extension of the improved Child Tax Credit into his budget, Reps. Rosa DeLauro (D-CT), Suzan DelBene (D-WA), Ritchie Torres (D-NY), and 207 additional Democratic cosponsors introduced the American Family Act (H.R. 3899) in the House, and Sens. Sherrod Brown (D-OH), Michael Bennet (D-CO), Cory Booker (D-NJ), Raphael Warnock (D-GA), Ron Wyden (D-OR), and 37 additional cosponsors introduced the Working Families Tax Relief Act (S. 1992) to extend the improved Child Tax Credit in the Senate.

7. Many Republican Policymakers Support Various Improvements to the Child Tax Credit: There are a number of proposals by Republican members to either improve or modify the Child Tax Credit. These include:

The Family Security Act by Sen. Mitt Romney (R-UT);

S. 74/H.R. 4789, Providing for Life Act of 2023, by Sen. Marco Rubio (R-FL) and Rep. Ashley Hinson (R-IA);

S. 4589, the Family and Community Inflation Relief Act of 2022, by Sen. Chuck Grassley (R-IA);

S. 1426, the Parent Tax Credit, by Sen. Josh Hawley (R-MO);

S. 2092/H.R. 4258, the Child Tax Credit for Pregnant Moms Act of 2023, by Sen. Steve Daines (R-MT) and Rep. Mariannette Miller-Meeks (R-IA); and,

H.R. 4520, Reignite Hope Act of 2023, by Rep. John James (R-MI).

All would expand the Child Tax Credit in one way or another.

Rep. Mike Lawler (R-NY) told Roll Call, “To my [Republican] colleagues in the majority — if we want to maintain the majority, we need to be talking about these issues.”

8. Support for the Child Tax Credit Has Been Bipartisan: The Child Tax Credit was initially proposed by the bipartisan National Commission on Children, which in 1991 wrote:

Because it would assist all families with children, the refundable child tax credit would not be a relief payment, nor would it categorize children according to their “welfare” or “nonwelfare” status. In addition, because it would not be lost when parents enter the work force, as welfare benefits are, the refundable child tax credit could provide a bridge for families striving to enter the economic mainstream. It would substantially benefit hard-pressed single and married parents raising children. It could also help middle-income, employed parents struggling to afford high-quality child care. Moreover, because it is neutral toward family structure and mothers’ employment, it would not discourage the formation of two-parent families or of single-earner families in which one parent chooses to stay at home and care for the children.

The Child Tax Credit was established by a Newt Gingrich-led Congress and signed into law by President Bill Clinton in 1997. Incremental improvements have been made to the Child Tax Credit over time and were signed into law by Presidents George H.W. Bush in 2001, Barack Obama in 2009, Donald Trump in 2017, and Joe Biden in 2021.

Moreover, as part of the 2017 tax bill, amendments by Sens. Rubio (R-FL) and Brown (D-OH) to further expand and improve the refundability of the Child Tax Credit were supported in some form by 68 senators, more than two-thirds of senators, but were not passed as votes in favor were unfortunately split between the two amendments.

9. Red States Benefit the Most from the Improved Child Tax Credit: According to an analysis by Reuters, the 10 states that benefitted the most from the 2021 improved Child Tax Credit were Utah, Idaho, South Dakota, Alaska, Nebraska, Wyoming, North Dakota, Iowa, Kansas, and Montana – all Republican-led states or “red states.” Lawmakers should be hard-pressed to oppose tax cuts that benefit their constituents.

According to Rep. James (R-MI), “I can’t imagine a more conservative thing than allowing the people — capital P — to keep their money rather than the government taking it.”

10. States Are Showing the Way: A study by the Jain Family Foundation found that, since 2011, 11 states have passed fully refundable Child Tax Credit laws on a bipartisan basis – ranging from $180 (Massachusetts) to $1,750 (Minnesota) per child. These bills have been popular and gained strong bipartisan support.

11. A Deal Can Be Reached to Merge Expired Tax Credits, such as the R&D Tax Credit and the Child Tax Credit: A major legislative priority of the business community is to allow businesses to “fully deduct” their current-year research and development (R&D) expenses. They argue that this deduction will lead to more research and innovation and benefit the economy.

Meanwhile, as noted earlier in #2 and #3, making investments in children, particularly low-income children, has both short- and long-term benefits to children and our society as a whole.

This is a marriage that makes a great deal of sense. As Sen. Brown (D-OH) said, “I’ll put it this way, no more tax breaks for big corporations and the wealthy unless the child tax credit’s with it. I’ll lay down in front of a bulldozer on that one.”

12. A Deal Can Be Reached on Providing an Enhanced Credit to Newborns/Pregnant Women with the Child Tax Credit: There is strong disagreement between groups over abortion, but there is one area where they could reach a deal, which is to increase the Child Tax Credit to babies. Democrats support Rep. DeLauro’s bill, which has language providing a “baby bonus,” while Republicans have introduced an array of bills by Sens. Romney, Rubio, and Daines and Reps. Hinson and Miller-Meeks to expand the credit to pregnant women.

The fact is that pregnancy and childbirth, by definition, often lead to, as researcher Laura Johnson reports in BMC Pregnancy and Childbirth, increased financial and health care stress, as women experience financial losses during and after pregnancy due to employment changes (e.g., bed rest, stop working, and unpaid family medical leave), increased household costs related to raising a baby, including child care and the health care costs of having a baby.

As Kathryn Taylor and colleagues report in an article published in JAMA:

…from 2013 to 2018, 24% [of preipartum women] reported unmet health care needs; 60%, health care unaffordability; and 54%, general financial stress. . .and lower household income was associated with higher odds of both unmet health care need and health care unaffordability.

Consequently, among both parties, there is a recognition that an expanded Child Tax Credit could benefit families dealing with increased financial and health care costs associated with pregnancy and having a baby.

However, under current law, newborns are disproportionately denied the full Child Tax Credit, which compounds the threats to the financial well-being and health of families with babies. According to Columbia University’s Center on Poverty and Social Policy, “31% of children in families with young children are left behind” and deemed either ineligible or only partially eligible for the Child Tax Credit. This figure is undoubtedly higher for newborns.

Supporters of the bills to add pregnant women to the Child Tax Credit argue that policy change is needed to support the health and financial needs of all pregnant women and babies. For example, Sen. James Lankford (R-OH) said, “Federal benefits available to moms should be available to all moms. I’m glad to join Senator Daines and our colleagues to ensure the federal government treats all moms the same, no matter how small or young her baby is.”

However, none of the bills that seek to add pregnant women to the Child Tax Credit do this because it is estimated that more than 90% of children in poverty and 36% of children in families with income between 100-200% of the supplemental poverty measure are denied access to the full credit under current law. Those figures are likely worse for newborns and the bill by Sen. Daines and Rep. Miller-Meeks does nothing to address this problem.

Thus, there is only one way to address this inequity and that is to make the Child Tax Credit fully refundable.

13. The Trump Tax Bill’s Child Tax Credit Provisions Expire in 2025: The individual tax provisions in the Tax Cuts and Jobs Act (TCJA) of 2017 expire in 2025, which would drop the credit to just $1,000 per child. If the TCJA provisions are extended in their current form in 2026, the Institute on Taxation and Economic Policy (ITEP) estimates the “poorest fifth of Americans would receive just 1% of that total while the richest fifth of Americans would receive nearly two-thirds.”

Extending the Child Tax Credit and making it fully refundable would be a way to at least partially rebalance this enormous disparity.

14. Kids Are at a Crossroads – It Is Well Past Time to Invest in Their Well-Being: Just a few weeks ago, First Focus on Children and Zero To Three co-released a report indicating that the federal government is quickly backtracking on the critically important investments that were made in children in 2021. In fact, the share of federal spending dedicated to children 0 to 3 years of age dropped from 1.93% of the federal budget in 2021 to just 1.54% in 2023 – a more than 20% reduction and a decline in spending of $34 billion.

As our joint Babies in the Budget report concludes:

Policymakers should heed the science of early brain development, which tells us that giving babies the resources to thrive not only aids their wellbeing, but delivers a significant return on investment for society. This analysis — which shows that our investments in the baby share of the budget are already insufficient and fall short of our spending in other areas — should give lawmakers pause. As a nation, we must invest in, not cut, the programs that families with young children need to thrive.

It should be no surprise that, on a variety of measures, we are witnessing disturbing trends for children, including rising child mortality, the doubling of child poverty, rising rates of uninsured children, a children’s mental health crisis, a child care crisis, and denial of basic human rights.

It is past time to invest in our children, their well-being, and our future. An improved Child Tax Credit would play a critical role in investing in our children and our future.

*****

If you would like to help ensure that children and their needs, concerns, and best interests are no longer ignored by policymakers, call your Member of Congress and urge them to expand the Child Tax Credit. You could also join First Focus on Children as an “Ambassador for Children” or become a paid subscriber to help us continue our work on behalf of children.