The Child Tax Credit Must Not Treat Children as an Afterthought

Far too often, policies that involve children fail to address their needs or concerns. In fact, children are often treated as an afterthought even when it comes to policies with “child” in the name. Instead, when the focus is on adults, institutions, or other economic interests, public policy typically shortchanges and fails our children.

That must change.

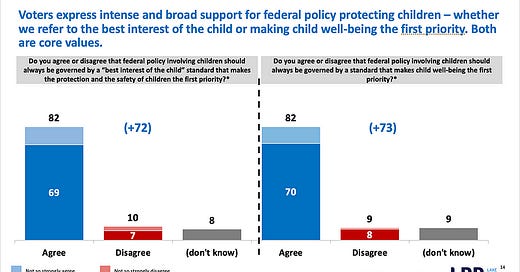

As child advocates, we must insist that policies involving and impacting children must address their “best interests” and make “child well-being” the focus. American voters agree by an overwhelming margin (82–10%).

In one of President Biden’s first directives, he instructed federal departments and agencies to make recommendations on “how the regulatory review process can promote public health and safety, economic growth, social welfare, racial justice, environmental stewardship, human dignity, equity, and the interests of future generations.”

Due to the strong advocacy by Reps. Rosa DeLauro (D-CT), Suzan DelBene (D-WA), and Ritchie Torres (D-NY) and Sens. Michael Bennet (D-CO), Sherrod Brown (D-OH), and Cory Booker (D-NJ), the American Rescue Plan Act (ARPA) included many important provisions of importance to “future generations,” including a much improved Child Tax Credit (CTC). This was a significant development for tens of millions of children and their families.

Prior to the enactment of ARPA, one-third of our nation’s children were “left behind” and received either nothing or only a fraction of the $2,000 per child that was available to other families earning up to $400,000 a year from the Child Tax Credit. This is due to an earnings test that phases in the credit based on income. In sharp contrast to wealthier families who receive $2,000 per child, low-income families received nothing before earning at least $2,500 and then 15% of earned income up to a maximum refundable amount of $1,400 adjusted for inflation (therefore, $1,500 in 2022).

In short, those who needed the Child Tax Credit the most got the least.

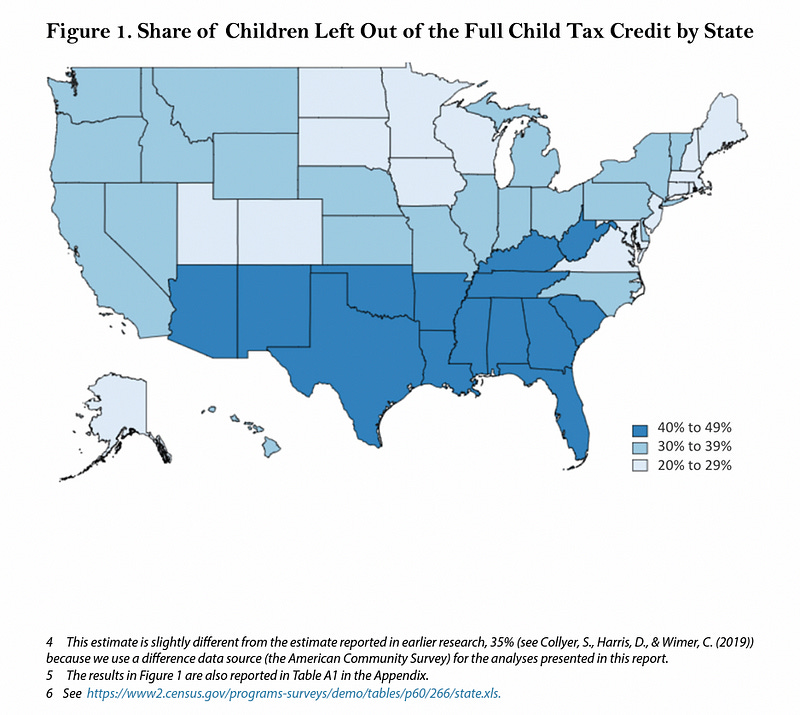

A May 2021 study by the Center on Poverty and Social Policy at Columbia University found that those “left behind” were disproportionately: (1) children under the age of 6 (40% receive only partial or no credit); (2) Black and Hispanic children; (3) children in single parent households (“70% of children in families headed by single parents who are female do not receive the full credit”); and, (4) children in rural communities.

A follow-up Dec. 2021 study by Columbia’s Center on Poverty and Social Policy also found that there are 15 states in which at least 40% of the children do not qualify for the full Child Tax Credit.

This corresponds very closely with the states with the worst outcomes for child well-being identified in the most recent KIDS COUNT report by the Annie E. Casey Foundation.

In fact, the 17 states with the highest rates where children do not qualify for the full CTC credit (39% or more) are also 17 of the 18 worst states when it comes to child well-being. The predominant reason for this nearly perfect overlap between states is child poverty.

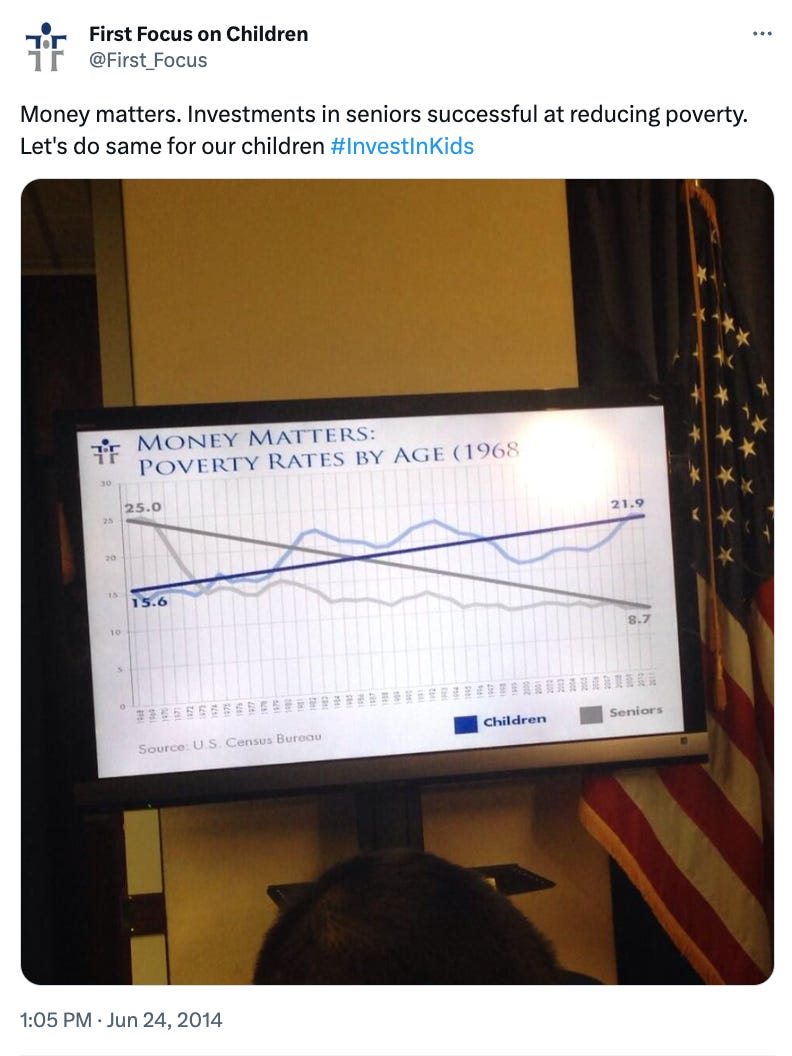

As we have been pointing out for years, money matters.

Fortunately for children, ARPA increased the Child Tax Credit from $2,000 per child to $3,600 for children under age 6 and $3,000 per child over the age of 6. The legislation also made the Child Tax Credit fully refundable, which meant that one-third, or 27 million, of our nation’s lowest income children would no longer receive only a partial or no credit because their parents made too little. Consequently, according to Columbia’s Center on Poverty and Social Policy, 3.7 million children were lifted out of poverty in 2021 because of the expanded and improved Child Tax Credit.

This policy improvement is supported by the American people. In a May 2022 Lake Research Partners poll, 72% of likely voters favor the provisions in the improved Child Tax Credit compared to just 21% in opposition.

Unfortunately, the improvements to the Child Tax Credit were temporary and expired at the end of 2021.

If Congress fails to act, the Child Tax Credit will drop from $3,600 per child under age 6 and $3,000 per child over age 6 in 2021 to just $2,000 per child (a 33–44% cut) this year. One-third of our nation’s children would, once again, be only eligible for either no (a 100% reduction) or partial payments because their families make too little to qualify for the full credit. Consequently, nearly four million children will be pushed back into poverty.

This is a policy choice.

In the Build Back Better Act (BBBA) passed by the House of Representatives on Nov. 19, 2021, the Child Tax Credit’s expanded amount of $3,600 for younger children and $3,000 for other children and youth was extended through 2022. It would have also permanently made the Child Tax Credit fully refundable.

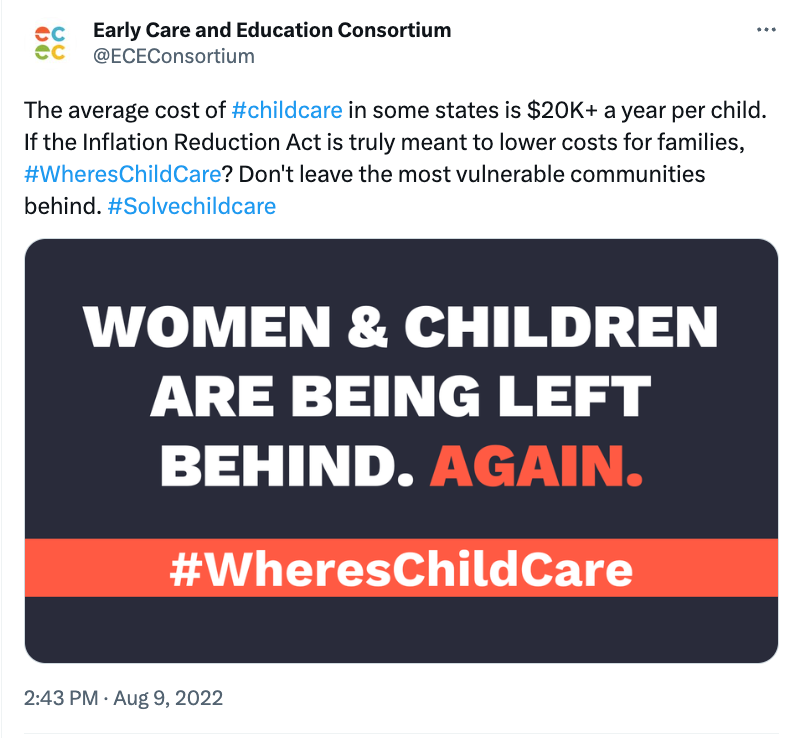

Unfortunately, the bill never made it through the U.S. Senate. Due to the objection of Sen. Joe Manchin (D-WV), the Child Tax Credit extension and a number of other provisions of importance to children, including child care, early childhood, family medical leave, and maternal child health, were removed from the renamed Inflation Reduction Act (IRA).

Children were left behind…yet again.

As a point of comparison, the House-passed Build Back Better Act used the word “child” or “children” 436 times. The Senate’s Inflation Reduction Act, which was signed into law by the President on Aug. 16, 2022, referenced “child” or “children” just four times and three of those times were made just to clarify that the bill was requiring coverage of adult vaccinations to Medicaid and the Children’s Health Insurance Program (CHIP).

So in reality, the 436 references to “child” or “children” in the House bill, which included numerous provisions of importance to children, were reduced to just one in the final legislation signed into law.

436-to-1!

The publicly stated objections from Sen. Manchin to the House-passed provisions of importance to children seemed to have little to nothing to do with children. In the case of the Child Tax Credit improvements, Sen. Manchin reportedly said the improved CTC might create a disincentive for people to work or that parents might buy drugs with the funding. His concern was centered around adults.

First, it is important to note that there is little to no evidence there were such problems with the Child Tax Credit in 2021. In fact, the evidence shows there is strong evidence of enormous benefit from a fully refundable and expanded CTC with little to no impact on work. As to the Tax Policy Center explains:

Overall, we find that families used the CTC to cover routine expenses without reducing their employment. Eligible families experienced improved nutrition, decreased reliance on credit cards and other high-risk financial services, and also made long term educational investments for both parents and children.

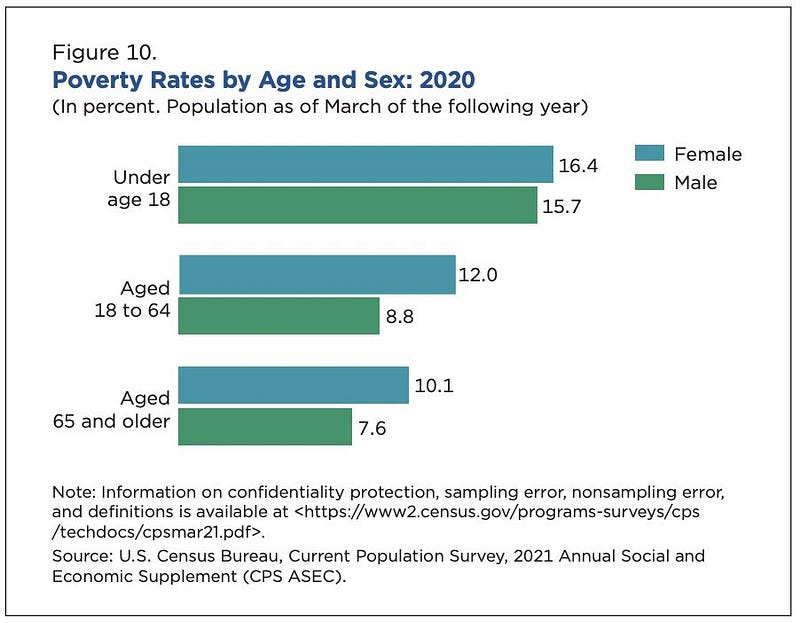

We also know that the past exclusion of low-income children from receiving the full Child Tax Credit has helped create a situation where the child poverty rate in this country has been much higher than that for adults (e.g., 59% higher than adults in 2020).

Again, this disparity is a choice — a terrible choice for children.

In fact, this has been a choice Congress has made repeatedly over the years. For example, the bipartisan National Commission on Children issued its final report in 1991 and recommended the creation of a fully refundable Child Tax Credit. The report reads:

The United States is the only Western industrialized nation that does not have a child allowance policy or some other universal, public benefit for families raising children…. Other nations that have adopted child allowance policies regard such subsidies as an investment in their children’s health and development and in their nation’s future strength and productivity.

The Commission’s recommendation received bipartisan support, as were its arguments recognizing the hard work that is parenting, the Child Tax Credit’s positive work incentives, and the proposal’s effectiveness in not punishing parents who choose to “stay at home” to care for their children.

Unfortunately, when the Child Tax Credit was established in 1997, it was not made fully refundable by the Newt Gingrich-led House of Representatives due to stereotypes about the “undeserving poor.” This has had the effect of creating a class of millions of “undeserving” low-income children for the last 24 years — more than a full generation of kids.

As NPR’s Greg Rosalsky reports:

Our welfare system has long spent generously on the old, but it has consistently skimped on the young. While America spends about as much, or even more on the elderly than many other rich nations, it spends significantly less on kids. Among the almost 40 countries in the OECD, only Turkey spends less per child as a percentage of their GDP. It’s a big reason why the United States has a much higher rate of child poverty than most other affluent countries — and even has a higher rate of child poverty than some not-so-affluent countries.

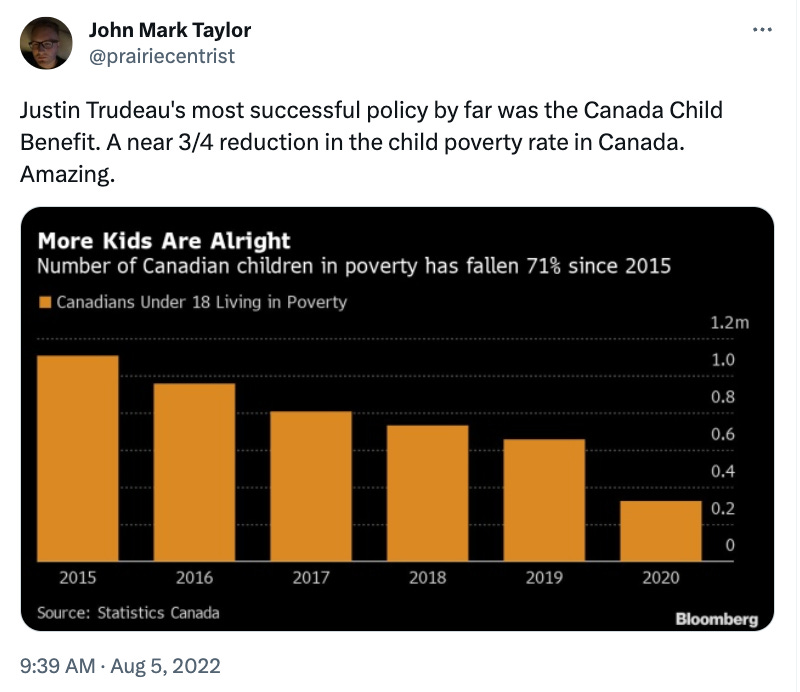

In recent years, the United States has fallen increasingly behind, as the federal share of investment in children dropped to an all-time low of 7.64% in President Trump’s last year in office while other nations, such as Canada, were making incredible progress for children.

Therefore, three decades after the National Commission on Children’s recommendation to make the Child Tax Credit fully refundable, ARPA made it a reality in the United States and was responsible for lifting nearly four million children out of poverty in 2021.

The potential benefits to children and society are immense. As Rosalsky explains:

…economists have found all sorts of benefits that derive from government spending on kids, including better educational outcomes, fewer health problems, lower crime and incarceration rates, and higher earnings (and tax payments) when the kids become adults.

One recent study in a top economic journal, by Harvard economists Nathaniel Hendren and Ben Sprung-Keyser, analyzed the bang-per-buck of government spending programs. They found that social spending on kids stands out as having far greater returns for society over the long run than spending on adults.

Unfortunately, the expanded Children Tax Credit expired at the close of 2021. To avoid backtracking and causing millions of children to be harmed, Congress needs to act to extend the fully refundable Child Tax Credit.

Millions of Children Left Behind: So Now What?

To his credit, Sen. Mitt Romney (R-UT) put forth a Child Tax Credit proposal that he called the Family Security Act in 2021. In the Family Security Act’s original draft, there were aspects of the bill that were superior to ARPA and BBBA Child Tax Credit provisions, such as the increase in the credit amount to $4,200 for younger children to age 6.

As Sen. Romney said:

Now is the time to renew our commitment to families to help them meet the challenges they face as they take on [the] most important work any of us will ever do — raising our society’s children.

…I want to support people who do have children, to make sure that the child is given the kind of care and treatment that we as a society want them to have.

Children were Sen. Romney’s initial focus, and therefore, his proposal offered an important opportunity for reaching bipartisan agreement on an extension of the Child Tax Credit.

Unfortunately, in version 2.0 of the Family Security Act that Sen. Romney has proposed with Sens. Steve Daines (R-MT) and Richard Burr (R-NC) this year, the focus of the proposal tragically shifted to adults.

Consequently, kids have been treated, once again, as an afterthought and subjected to “deservingness” standards that target parents. As examples, the bill’s earnings threshold causes disproportionate harm to low-income children and children in single parent households while other changes bar some children with immigrant parents and children cared for by people other than their parents, such as grandparents, from qualifying for the Child Tax Credit.

As Shawn Fremstad at the Center for Economic and Research Policy explains, Romney’s latest proposal “assigns children” to categories of “deserving, semi-deserving, and undeserving.” Through the imposition of “deservingness” criteria upon children, Romney’s latest proposal has the effect of deciding that some children are somehow more worthy than others and singles out financial penalties upon millions of children who are most in need.

Simultaneously, to gain the support of anti-choice groups, Sen. Romney would add pregnant women to the Child Tax Credit. As a result, in Romney 2.0, pregnant women would receive $700 a month from the Child Tax Credit compared to a monthly maximum benefit of “$350 a month for a young child and $250 a month for a school aged child.” The proposal includes offsets that create an array of winners and losers — with wealthy pregnant women being the greatest beneficiaries and millions of children in need worse off than even under current law.

As a point of comparison, the legislation, the American Family Act, supported by Sens. Bennet, Brown, and Booker and Reps. DeLauro, DelBene, and Torres and included in ARPA and BBBA would, according to Columbia’s Center on Poverty and Social Policy, reduce child poverty by 4 million or 44.9% when fully implemented. Again, in the May 2022 Lake Research Partners survey, this improved version of the Child Tax Credit is supported among likely voters by a wide 72–21% margin.

In contrast, the Niskanen Center estimates that Romney’s Family Security Act 1.0 would cut child poverty by 2.8 million or 32.6%. The Niskanen Center’s estimate drops to just 1.1 million or 12.6% for Romney 2.0.

Compounding the downside of Romney 2.0, the Center on Budget and Policy Priorities (CBPP) estimates, that beyond the changes to child poverty, an additional 10 million children would be left worse off by a combination of changes to the Earned Income Tax Credit, elimination of the head of household filing status, and elimination of the child portion of the Child and Dependent Care Tax Credit.

Children who live in poverty or with a low-income, single, young, disabled, or immigrant parent should not somehow judged as less worthy by society and government public policy than other children simply because of some sort of “deservingness” standard imposed upon their parents.

The Child Tax Credit provisions in Romney’s Family Security Act 1.0 did not discriminate in this manner, but version 2.0 does in rather unfortunate ways. For example, in Romney-Daines-Burr, a pregnant woman with a 3-year-old child making $400,000 a year would receive $1,050 a month ($700 for the pregnant woman and $350 for the child) and $700 per month ($350 per child) after birth from the Child Tax Credit.

In sharp contrast, a single mother with two children ages 3 and 6 at an income at $5,000 (half of the $10,000 earnings test in order to receive the full credit) would receive just $300 a month or 57–71% less than the amount for the much wealthier pregnant mother. There is no policy argument that can be made to justify such a dramatic disparity in treatment to children.

As CBPP explains:

This is a serious flaw because the children denied the full credit are the very children who stand to benefit the most, in both the short and long term, from the additional income it could provide.

Even worse, a pregnant 14-year-old teenager, who might be forced to carry to term in some states post-Dobbs, would receive absolutely nothing under the Romney-Daines-Burr proposal because the pregnant teen failed to work as a 13-year-old due to the fact his earnings test is based on the prior year’s income. This is nonsensical.

Compounding the harm, the teenager’s child would not qualify for the full Child Tax Credit until the teenage mother either begins working or relinquishes custody of her child.

According to a New York Times analysis of how states rank with respect to measures of well-being for women and children, the states most likely to ban abortion have much worse health and well-being outcomes for women and children (e.g., children in poverty, uninsured women and children, low-birthweight babies, teen births, and infant and maternal mortality). As demonstrated earlier as well, denying or providing just a partial credit to such families only exacerbates the harm.

Conservatives are struggling with how to balance differing policy demands from the anti-choice community, the social engineering “deservingness” crowd, and proponents of family values. These differences are often incompatible. And when it comes to the Child Tax Credit, they often fail to be focused on the best interests or well-being of children. In fact, their disparate demands work in combination to create some rather bizarre policies that have tragic consequences for children.

As an example, Sens. Marco Rubio (R-FL) and Mike Lee (R-UT) have committed to introducing a Providing for Life Act, which also will include provisions related to Child Tax Credit. Although the maximum amount of the CTC per child will reportedly be higher ($4,500 per child under age 6 and $3,500 per child ages 6–16) in their proposal, the phase-in of the benefit results in parents needing to earn much more in order to qualify for the full credit. Helping provide supports for mothers and babies comes in sharp conflict with the demands by some conservative think tanks, such as the Heritage Foundation and even Sen. Rubio himself, to deny support to poor women and children.

As Niskanen Center’s Robert Orr points out:

Under Rubio’s plan, a parent with two younger children, for instance, would need to earn a bit over $42,500 in order to receive the full value of child credits they are eligible for…

Orr adds:

The Rubio proposal would, for example, do little for a 19-year-old woman with an unplanned pregnancy and limited work experience — the very sort of household most likely to be affected by Dobbs, as well as for whom financial support can be the deciding factor in whether to keep their child in states where abortion remains legal.

Unfortunately, Sen. Rubio’s plan would create even greater disparities than Romney’s 2.0 version, particularly for lower income families with children.

For far too long, children have been treated as an afterthought when it comes to public policy, even when that policy is about children. Advocates for children must insist that public policy involving children be governed by a best interests standard.

As the National Academy of Sciences, Engineering and Medicine (NASEM) has found, reducing child poverty improves the health and education of children and reduces child hunger, child homelessness, and child abuse and neglect. NASEM estimates child poverty costs our society up to $1.1 trillion annually.

Investing in children is good for children and good for our country. A comprehensive analysis by Irwin Garfinkel and colleagues at Columbia’s Center on Poverty and Social Policy finds making the Child Tax Credit fully refundable is “a winning investment in our children’s future mobility.”

The authors add:

While the initial costs may appear large, they are small compared to the very large monetary benefits that would eventually accrue to recipients and society from investing in children. The value to society that flows from these impacts is approximately eight times the annual costs: converting the Child Tax Credit to a child allowance would cost about $100 billion and would generate about $1 trillion, or about $10 for every dollar spent in benefits to society.

Finding Compromise?

Every aspect of the lives of children has been negatively impacted by the global COVID pandemic and the resulting economic recession. ARPA and the improved Child Tax Credit played an important role in helping to mitigate the financial harm to children and families.

Consequently, now is not the time to roll back those improvements, push four million children back into poverty, and raise taxes on millions of families across this country by $1,000–3,600 per child.

Anyone concerned about children wants to see action on the many things dropped from the reconciliation package (the 436 references to “child” or “children”), including the Child Tax Credit, child care, education, early childhood, child nutrition, and maternal child health.

As Marian Wright Edelman, founder and president emerita of the Children’s Defense Fund, writes:

Our failure and refusal to center our children’s needs and invest in policies to end preventable child poverty and deprivation is a moral blight on our nation. We know what works, which makes it all the more shameful that we’ve let the CTC lapse and let millions of children fall back into poverty.

In order to find a pathway forward, Professor Bruce Fuller argues in a recent opinion piece that President Biden should engage with Sen. Romney in some sort of “late-summer romance” on the Child Tax Credit. That would have been much easier to do under Romney 1.0, as the focus would have been on the best interests of children.

But Professor Fuller has also negatively described other legislation by Sen. Josh Hawley (R-MO), the Parent Tax Credit, as a form of “social engineering” intent upon “shaming single parents,” as it provided twice the credit to married parents than single parents. Unfortunately, the Family Security Act 2.0 has policies that also punish the children of single parents and engage in other forms of “deservingness” criteria on CTC eligibility.

As noted above, legislation by Reps. DeLauro, DelBene, and Torres and Sens. Bennet, Brown, and Booker would protect children from falling back into poverty. In Sen. Romney’s Family Security Act 2.0, three million children would slip back into poverty and children in Sen. Rubio’s bill would fare even worse.

So which of the millions of children do proponents of a compromise on Romney 2.0 or Rubio believe are “undeserving” and should be pushed back into poverty?

The children of parents with disabilities? The siblings of children with disabilities, whose parents can only work part-time or quit to take care of their kids? The children of stay-at-home mothers? The children whose parents cannot afford child care and must work limited hours? The children whose parents have had to quit to take care of their own frail and elderly parents? The children of immigrants, including U.S. citizen children and DREAMers? The children of teenage mothers, including those who are victims of child trafficking, rape, incest, or failed contraception? The children in single parent households? The children being cared for by grandparents or other relatives while parents are undergoing medical care or substance abuse treatment? The children being cared for by grandparents or other relatives due to allegations of abuse or neglect by parents? The children of parents who are incarcerated? The children of parents who lost their jobs due to changes in the global economy, the pandemic, automation, etc.? The children of farmers who lost their crops due to natural disasters or drought? The children of parents who are in college or job training programs? The children of women who leave abusive and violent relationships? The children who lost a parent due to cancer, COVID, a heart attack, stroke, etc. and thereby live in a household with reduced income? The children who lost a parent due to service in the military or as a police officer or firefighter and thereby live in a household with reduced income?

These are the types of questions that are raised when the focus on legislation of importance to children shifts to the “deservingness” of parents. It is the children who are most negatively impacted but are somehow forgotten or treated as an afterthought, even when the bill has the word “Child” in its title.

The negative consequences are endless and they include an array of unintended consequences. As noted earlier, Sen. Rubio plans to release a self-described “pro-family framework” of initiatives following the Dobbs decision to “provide comprehensive support for pregnant and new moms, as well as young children.”

One of those bills is the Pregnant Students Rights Act, which requires ‘higher education institutions to publicly disclose the resources and rights available for pregnant and parenting students” and to report on whether students ‘considered dropping out or withdrawing from classes because of pregnancy, new motherhood, stillbirth, or miscarriage.”

The irony here is that Sen. Rubio’s own Child Tax Credit proposal would be such a reason for dropping out or withdrawing due to the reality that college students would be unlikely to qualify for the CTC because they earned too little under his bill.

Again, as Orr points out:

…Rubio’s proposed child tax credit is much less generous to low- and middle-income households than Romney’s proposal, particularly for families with multiple and/or younger children.

Orr’s analysis finds that Rubio’s plan would require about $25,500 for a parent of a young child “to receive the full value of the expanded CTC.” This increases to $42,500 for a parent with two younger children.

For this and other reasons, Orr concludes:

…it’s safe to say that Rubio’s CTC expansion largely misses its intended population.

Again, since Rubio’s stated goal is to provide “comprehensive support for pregnant and new moms, as well as young children,” his Child Tax Credit plan would fall grievously short in providing the necessary supports for women and children.

It is well past time to do what’s best for all of our children and their mothers. It is good for them. But the fact is, as the evidence clearly shows, failing them does harm to our nation and our future.

*****

If you would like to help ensure that children and their needs, concerns, and best interests are no longer ignored by policymakers, please consider joining us as an “Ambassador for Children” or becoming a paid subscriber to help us continue our work on behalf of children.