A Moment of Moral Reckoning

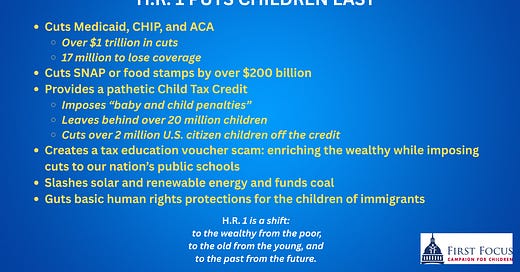

Congress faced stark and foundational choices when it started writing H.R. 1, their major budget and tax bill for the year.

They looked over at 37 million children covered by Medicaid and the Children’s Health Insurance Program (CHIP) and 15 million children who rely on the Supplemental Nutrition Assistance Program (SNAP) – children with no Political Action Committees (PACs) and lobbyists roaming the halls of Congress on their behalf. On the other side, they considered the NRA and the gun manufacturers, who do have a PAC and dozens of lobbyists, sought a tax break for gun silencers.

Congressional leadership had a choice and chose gun silencers over children.

Or take the parents of children with disabilities, asking and pleading for Congress to preserve Medicaid for their kids. Upon consideration, H.R. 1 demonstrates Congress’s answer to them: “No. We would rather slash your child’s Medicaid to fund tax breaks for corporations and the richest Americans.”

These are not abstract policy decisions. They are moral decisions. And they demonstrate how H.R. 1 is failing our nation’s children.

In my lifetime, I cannot think of a bill that is worse for kids. And in the context of the broader war on children orchestrated by the Trump Administration (just yesterday, the Trump Administration unilaterally withdraw another $7 billion of dollars in funding for educational programs for children that had been funded by Congress and were signed into law), this is a devastating time for children in our nation.

A Trillion-Dollar Raid on Children’s Health Care

H.R. 1, which is the top legislative priority of President Trump’s and congressional leadership threatens to fundamentally weaken the health, development, nutrition, economic security and undercut the future prospects of tens of millions of America’s children.

Instead of lifting and protecting our nation’s children, H.R. 1 places the next generation in greater peril – now and for decades to come.

First and foremost, the bill slashes more than $1 trillion from Medicaid and the Children’s Health Insurance Program (CHIP). These two programs provide health insurance coverage to over 37 million children to protect them from cancer, cover neonatal intensive care unit (NICU) stays, treat asthma, and ensure vaccines and routine checkups.

H.R. 1 would:

Resurrect barriers like CHIP waiting periods and lock-outs.

Slash retroactive Medicaid coverage from 90 days to 30 days, trapping families in debt for emergencies that happened before paperwork could be filed.

Impose new provider tax restrictions that threaten pediatric care, including children’s hospitals, and even cut eligibility outright.

Enact work requirements that risk parent coverage, destabilizing the very families children depend on.

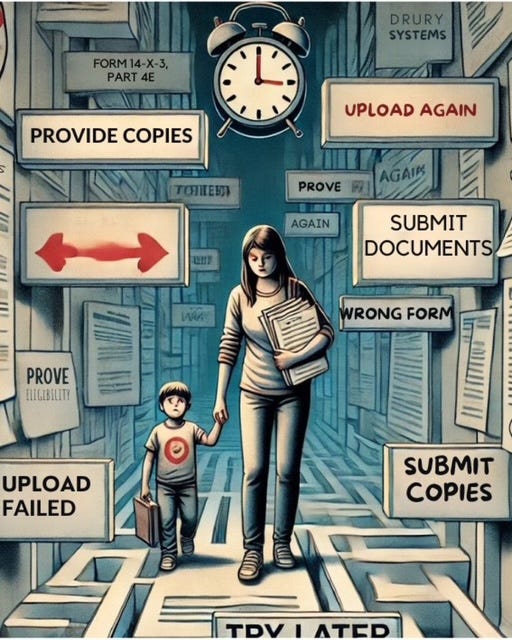

And contrary to promises of “efficiency,” these measures do nothing other than impose an enormous regulatory and bureaucratic burden upon children and families – forcing parents to navigate bureaucratic mazes to enroll in and retain their health care coverage.

Driving More Children into Hunger

The bill doesn’t stop at health care. It cuts around $200 billion from SNAP, the program that feeds over 15 million children. These are kids who already face food insecurity – kids who concentrate and perform better in class simply because they had breakfast. To make matters worse, the bill also threatens school meals for children across this country.

With less SNAP support and school meals, more children will experience hunger, which not only stunts physical growth but impairs brain development and learning, and echoes across a lifetime. While giving massive tax breaks to corporations and the wealthy, Congress has shown they are unconcerned about child hunger and poverty.

A Sham Child Tax Credit That Leaves Millions Behind

During the 2024 presidential election, Vice Presidential candidate J.D. Vance made some promises to expand the Child Tax Credit to $5,000. More recently, President Trump talked openly about providing a $5,000 baby bonus to help support families having babies.

As is often the case, these were empty promises. Rather than supporting children and families, H.R. 1 offers a paltry Child Tax Credit that:

Provides just $2,200 per child, failing to even keep pace with inflation since 2017.

Leaves more than 20 million children with only partial or no credit (i.e., “baby and child penalties”).

Disproportionately denies babies whose moms lose income during pregnancy and childbirth with a reduction or elimination of credits for both the newborn baby and their siblings.

Threatens larger families with a reduced Child Tax Credit because it takes larger families much more income to qualify for the full credit than smaller families.

Denies children and families who are victims of natural disasters – including hurricanes, tornadoes, wildfires, flooding, and drought – with a loss of their Child Tax Credit.

Eliminates or reduces the Child Tax Credit for millions of children who have had a primary wage-earner die — leaving 1-in-12 of children in the U.S. with a greater likelihood of a federally-imposed penalty for their tragic circumstances.

Blocks an additional 2.6 million U.S. citizen children, who are fundamental to our nation’s future, from receiving the credit outright simply because they live in mixed-status immigrant households.

This policy not only drives more children into poverty, but it also sends a chilling message: that because of who their parents are, and even though they are suffering from tragedy or unfortunate circumstances, children are somehow less worthy of help and deserve to be penalized.

Congress is choosing to punish children who are most in need by providing them the least. It’s the very opposite of what a just nation should do.

“Trump Accounts”: A False Promise That Widens Inequality

H.R. 1 also introduces so-called “Trump Accounts” — savings accounts seeded with a one-time $1,000 contribution at birth. On the surface, this might seem like a step forward for children. But the design all but guarantees that over time, these accounts exacerbate inequality rather than reduce it.

Why? Because wealthier families can afford to contribute additional money each year and benefit more from compounding interest, while lower-income families, who most need help building assets, are least able to contribute to the accounts. Over decades, these accounts would become yet another vehicle to enrich families who already have wealth, while leaving children from struggling households even further behind.

It’s a classic example of policy window dressing: a program pitched as support for kids that actually cements and increases existing disparities.

Instead, we should be adopting policies that President John F. Kennedy called for in a speech on June 11, 1963:

. . .not every child has an equal talent or an equal ability or an equal motivation, but they should have an equal right to develop their talent and their ability and their motivation, to make something of themselves.

The “Trump Accounts” in H.R. 1 do the opposite.

They are also a far cry from the $5,000 baby bonus that, as noted above, Trump said he was considering just weeks ago.

Targeting Early Educators and Worsening the Child Care Crisis

H.R. 1 also attacks early childhood by stealth. It bans federal student loans for programs where graduates earn less ($32,000) than the median high school graduate salary ($39,000) – a cruel standard that penalizes entire sectors where pay is low because we’ve underfunded them for decades.

In nearly every state, child care professionals earn below this threshold. So instead of fixing the root problem of low pay, the bill punishes early childhood educators, denying them the chance to train and improve, deepening shortages, and pushing up costs for families already struggling to find care.

Meanwhile, nearly one-third of child care workers rely on Medicaid, and 43% depend on safety net programs like SNAP. Slashing these programs compounds their economic insecurity – risking an exodus from a workforce we desperately need.

Siphoning Money from Public Schools Through a Voucher Tax Scam

H.R. 1 creates a costly education voucher tax credit that diverts critical resources away from public schools. The voucher tax credit:

Provides an unlimited tax benefit to wealthy donors, who can even profit by double-dipping on state and federal deductions.

Gives private schools 2-3 times the tax benefits of other nonprofits, including houses of worship and homeless shelters.

Opens the door to discrimination against students for reasons like religion, sexual orientation, or family income.

Meanwhile, decades of evidence show vouchers do not improve academic outcomes and disproportionately benefit families who already send their children to private schools.

In the name of children, H.R. 1 enriches the wealthy at the expense of our nation’s public schools.

More Money for Family Separation in Immigrant Households

Even as it guts essential supports, H.R. 1 dramatically increases funding for immigration enforcement, fueling policies that tear families apart and leave children traumatized.

This doesn’t just harm children emotionally. It creates a chilling effect, where many immigrant families avoid enrolling their eligible children in Medicaid, SNAP, or school meals programs out of fear – even when those kids are U.S. citizens. This happened during the first Trump Administration too and will result in more children going without health care or food, purely because of intimidation.

It’s a stark vision: billions more to ICE to create immense trauma to children via family separation or to deport U.S. citizen children (even those with life-threatening illnesses) while stripping billions of dollars to feed, care, and provide the Child Tax Credit to the children of immigrants.

Slashing Clean Energy for Our Kids’ Future

H.R. 1 not only cuts health care and food for kids, but it also guts investments in solar and renewable energy, programs critical to tackling the climate crisis that threatens children’s futures. Instead of helping communities transition to clean energy, the bill doubles down on the past by pouring more money into coal and fossil fuel interests.

At a time when children face growing health threats from climate-fueled wildfires, extreme heat, and air pollution that worsens asthma and other chronic conditions, this bill moves in exactly the wrong direction.

It’s another way H.R. 1 shifts costs onto kids: forcing them to pay, quite literally, with their health and their environment.

Tax Breaks for Gun Silencers, Debts for Our Children

One of the most galling provisions in the bill is a tax break for gun silencers.

Gun violence is the leading cause of death for children and teens in the U.S., yet Congress proposes cutting health care to give a handout to gun accessories designed to make weapons quieter and shootings harder to detect.

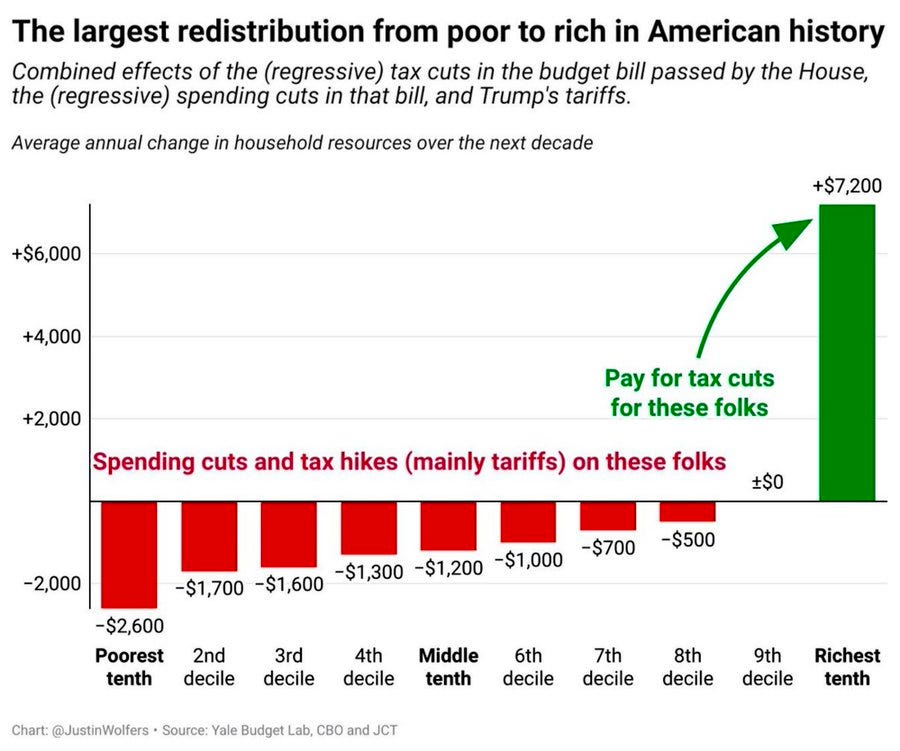

All of this, combined with trillions in tax cuts for the wealthiest households, piles up new debt that our children and grandchildren will be left to pay off for decades. It’s not just robbing them of opportunity today – it’s a choice that mortgages their future and lives.

Ballooning the Debt and Sending the Bill to Our Children

On top of all its cuts to children’s health care, nutrition, and education, H.R. 1 also drives the national debt up by more than $3 trillion. That means even as lawmakers slash vital investments that help kids thrive today, they’re also handing those same children a massive IOU to pay off tomorrow.

In effect, it’s a double hit on the next generation:

Cuts to the supports that help them grow up healthy and secure, plus

New debts they will shoulder as tomorrow’s taxpayers.

This is the very opposite of stewardship. Instead of building a strong foundation for the future, H.R. 1 hollows it out, forcing children to pay twice – once through reduced investments in their opportunities now, and again through higher taxes or reduced services in adulthood.

It is always easier to tear things down and far more difficult to build them. This bill will have devastating consequences for years, if not decades, to come.

It’s hard to imagine a more striking example of intergenerational injustice.

A Bill That Fails the “Is it Good for the Children?” Test

As President Teddy Roosevelt said in a Feb. 21, 1912, speech to the Ohio Constitutional Convention:

It is of the utmost importance that in the future we shall keep the broad path of opportunity just as open and easy for our children as it was for our fathers….

Unfortunately, his bill shortchanges children and their needs, while simultaneously driving the largest transfer of wealth in modern American history:

From the young to the old.

From the poor to the wealthiest.

From the future to the past.

Professor Scott Galloway speaks to this issues in this moment in time and specifically to this bill:

The math isn’t mathing: Older/wealthier Americans are running up younger/poorer Americans’ credit cards to maintain their lifestyle.Unfortunately, our children are facing enormous challenges, and H.R. 1 makes it all worse.

We know from the National Academy of Sciences that child poverty alone costs our economy up to $1.1 trillion each year. We know from decades of research that cutting health care, nutrition, and income support for kids results in worse health, poorer educational outcomes, lower lifetime earnings, higher costs to society, and even death.

At a time when America’s children face higher infant and child mortality rates, rising poverty, increases in food insecurity, a surging mental health crisis, and growing homelessness, they deserve policies that meet this moment with urgency and care.

Instead, H.R. 1 does the opposite. It fails every credible “Is it good for the children?” test. It is not just flawed policy – it is a moral failure and a historic injustice.

We Must Do Better

Our children don’t have lobbyists or super PACs. They can’t vote. They depend on us – the adults – to be their champions.

We urge Congress to reject H.R. 1, and instead, pursue legislation that truly invests in the health, nutrition, safety, and economic security of America’s children.

And we urge everyone reading this to speak up: call your representatives, share this newsletter, demand that our nation’s leaders put children first – not last.

Because a country that fails its children fails itself and everyone’s future.

If you would like to help ensure that children and their needs, concerns, and best interests are protected and no longer ignored by policymakers, please consider joining us as an “Ambassador for Children” or becoming a paid subscriber to help us continue our work on behalf of children.