From Rhetoric to Reality: The Battle to Fix the Child Tax Credit's 'Baby and Child Penalties’

We have all heard it: politicians saying something to the effect that “every life is precious” when it comes to pregnancy or the birth of a child. Here are a few examples:

“In the United States, we believe in the sanctity of life and the value that each child brings into this world.” – Sen. Rick Scott (R-FL)

“Every life is precious. As a father of six, I cannot express enough how precious the lives of innocent children are.” – Sen. Markwayne Mullin (R-OK)

We have also seen it, as every election season is filled with pictures of politicians holding or kissing babies.

The question arises: is this just empty rhetoric and performative or do policymakers care about and adopt public policies that truly value every precious baby?

As my last newsletter highlights, the evidence is mixed – at best. For example, First Focus on Children and Zero to Three published a report that finds babies and toddlers represent 3.4% of the U.S. population but just 1.5% of all federal spending.

This lack of investment occurs despite overwhelming evidence that investing in children, particularly babies and toddlers, has an enormous long-term benefit to them and society.

Fortunately, there are some policymakers, such as Reps. Rosa DeLauro (D-CT), who are dedicated to making children and families a priority in her work. For example, Rep. DeLauro is chair of the Babies Caucus in the House of Representatives and is the lead sponsor of a slew of bills that would improve the lives and well-being of children.

Focusing on the Child Tax Credit, Rep. DeLauro has introduced H.R. 3899, the American Family Act with 210 cosponsors, which would improve the Child Tax Credit by making the credit fully refundable for all children and increases the amount to $3,600 annually for children under the age of 6 and to $3,000 for all other kids under the age of 18. The bill also includes a baby bonus, which would provide additional funding for an infant, and would cut child poverty by almost half.

Sens. Sherrod Brown (D-OH), Michael Bennet (D-CO), and Cory Booker (D-NJ) have a similar piece of legislation, the Working Families Tax Relief Act (S. 1992), that would benefit babies and kids.

In the State of the Union, President Joe Biden raised the need to restore the provisions of the improved Child Tax Credit and specifically cited its impact on cutting child poverty and child hunger.

There are or have been several Republican bills to expand the Child Tax Credit as well.

The Family Security Act by Sen. Mitt Romney (R-UT);

S. 74/H.R. 4789, Providing for Life Act of 2023, by Sen. Marco Rubio (R-FL) and Rep. Ashley Hinson (R-IA);

S. 4589, the Family and Community Inflation Relief Act of 2022, by Sen. Chuck Grassley (R-IA);

S. 1426, the Parent Tax Credit, by Sen. Josh Hawley (R-MO);

S. 2092/H.R. 4258, the Child Tax Credit for Pregnant Moms Act of 2023, by Sen. Steve Daines (R-MT) and Rep. Mariannette Miller-Meeks (R-IA); and,

H.R. 4520, Reignite Hope Act of 2023, by Rep. John James (R-MI).

Sen. Mike Lee (R-UT) has this to say, “The Child Tax Credit supports families through the increased costs of raising children. It is a societal statement recognizing the value that children and parents bring to our country….”

Support for the Child Tax Credit has often been bipartisan. In 2017, as part of the 2017 tax bill, amendments by both Sens. Rubio (R-FL) and Brown (D-OH) to further expand and improve the refundability of the Child Tax Credit were supported in some form by 68 senators, more than two-thirds of all senators, but were not passed because votes in favor of improving the credit were unfortunately split between the two amendments.

Investing In Babies

The evidence is overwhelming that there are enormous benefits in both the short- and long-term to investing in young children and lifting them out of poverty. Unfortunately, babies are the age group most likely to live in poverty in the U.S.

Source: Robert Orr, “Why Child Tax Credit expansions should prioritize younger children,” Niskanen Center.

For these children, we should be investing more heavily in their well-being – not less. Unfortunately, our nation’s public policies often do the opposite.

For example, because the Child Tax Credit is not fully refundable for all children, certain kids in families who make “too little” do not qualify for the full $2,000 per child credit. Consequently, according to a study by Columbia University’s Center on Poverty and Social Policy (CPSP), because the Child Tax Credit is tied to parental wages, there are 18 million, or 26% of all children, who are “left behind” and either qualify for partial credit (17%) or are denied the credit entirely (9%).

A previous CPSP study found that the kids “left behind” are disproportionately: (1) children under the age of 6 (40% receive only partial or no credit); (2) Black and Hispanic children; (3) children in single-parent households (“70% of children in families headed by single parents who are female do not receive the full credit”); and, (4) children in rural communities.

As we wrote in our latest issue brief on the Child Tax Credit:

If we are truly concerned about the well-being and best interests of our children and grandchildren, we should strive to eliminate child poverty and the harm it inflicts on our nation’s kids.

That begins by no longer accepting that babies and children should suffer from policy decisions that leave or even push babies and children into poverty.

Recognizing the Child Tax Credit’s “Baby Penalty”

Whether intentional or not, babies are disproportionately “left behind” in the Child Tax Credit due to the credit’s ties to income. Columbia CPSP researcher David Harris explains that the parents of children are younger and thus “earlier in their earnings trajectory than the parents of older children.” Furthermore, mothers are more likely to be in and out of the workforce with babies for numerous reasons, including complications due to pregnancy, labor and delivery, postpartum health issues for mother, baby, or both, the lack of child care, lack of paid family medical leave, etc.

In fact, according to research by Alexandra Stanczyk:

On average, households experience significant declines in income-to-needs that begin three months before the birth month, reach the lowest level – around 34 percent lower than the pre-pregnancy baseline – in the first and second months of the infant’s life, and do not recover to pre-pregnancy levels in the year following the birth.

Even after adjusting for other household income, including public benefits, Stanczyk finds household income still drops by more than 10% around the time of birth and fails to reach pre-pregnancy levels in the year following birth.

Since the Child Tax Credit is tied to wages, Harris explains that babies are often cut out or receive a significantly reduced credit and calls this a “baby penalty.”

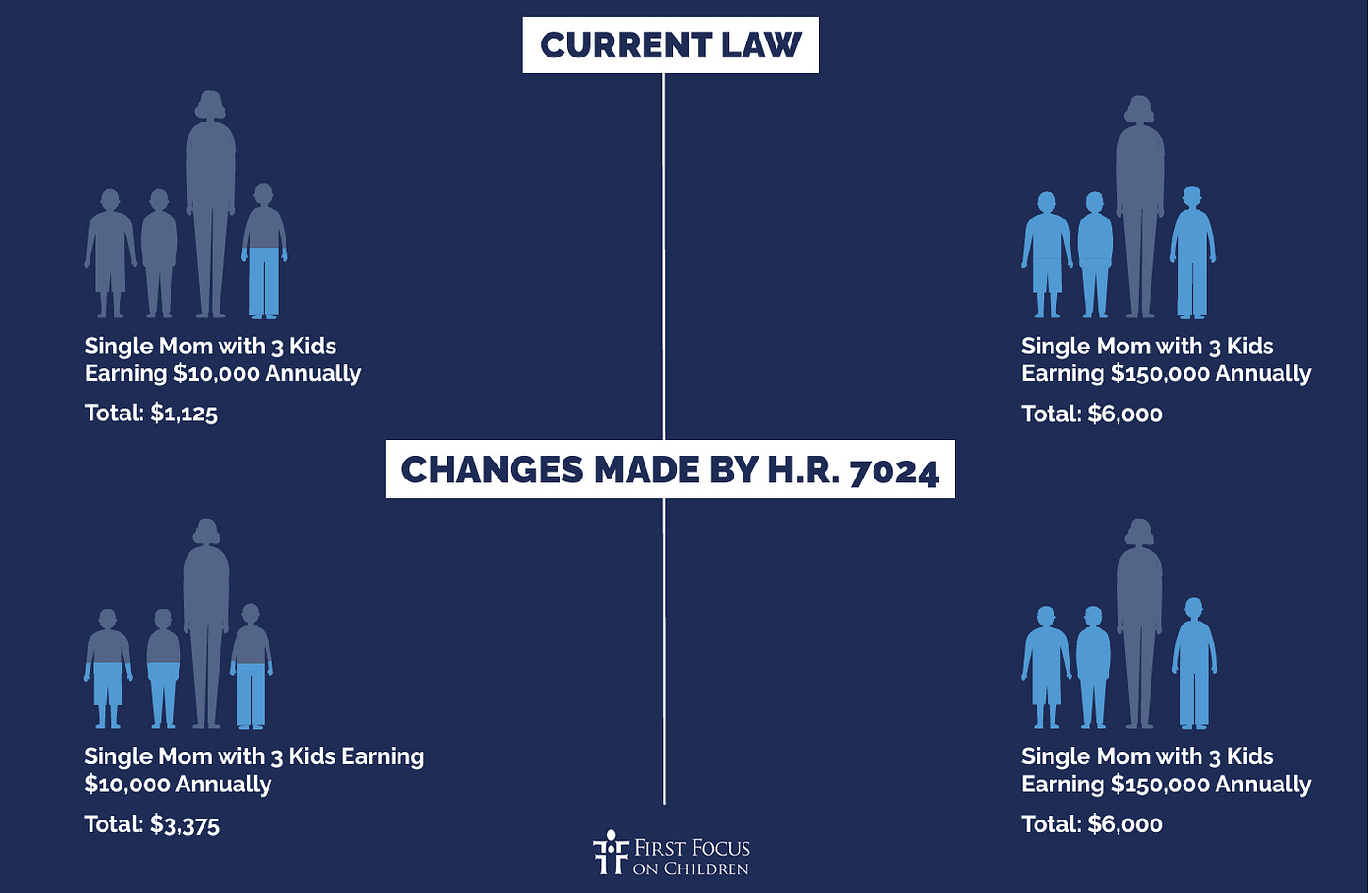

As an example, the 3 children in a single-parent household with earnings of $150,000 a year would each qualify for the full credit, which is $2,000 per child or $6,000 in total.

In contrast, in a family with 2 children and a baby with a single parent who experienced a reduced income of just $10,000 due to issues related to childbirth, the first child would receive a reduced credit of $1,125 and both the other child and baby would receive nothing for a total of just $1,125 (see chart below).

In this comparison, a wealthy parent with 15 times the level of income to support their kids would also receive 3.6 times more funding from the Child Tax Credit. This is nonsensical public policy. For low-income families having a baby, they are subjected to a “triple-whammy”: (1) having more expenses associated with having a child; (2) losing income associated with having a child; and, (3) having their Child Tax Credit cut because they had a baby.

Taking Steps to Fix the “Baby and Child Penalties”

As noted earlier, legislation by Rep. DeLauro (H.R. 3899) would eliminate all child penalties but also take the step of providing a “baby bonus.” This is the definition of truly valuing all of our babies and children.

However, under the construct of keeping the Child Tax Credit tied to earnings, Senate Finance Committee Chairman Ron Wyden (D-OR) and House Ways and Means Chairman Jason Smith (R-MO) have crafted H.R. 7024, the Tax Relief for American Families and Workers Act of 2024 to help low-income children and their families. That bipartisan legislation passed the House by an overwhelming 357-70 margin.

Although the bill is far from perfect and not close to what kids ultimately need, it does take some important steps to partially mitigate both the “child and baby penalties” in the underlying law. Specifically, the legislation would change the Child Tax Credit in ways that are estimated to:

Cut child poverty by 400,000 in the first year and 500,000 or more when in full effect;

Benefit 16 million children, or more than 80% of the 18-19 million who currently get no or only partial credit in the first year;

Benefit 3 million children under the age of 3 in the first year;

Dramatically reduce the child penalty that is currently imposed on children in larger families;

Assist children by increasing family and economic stability; and,

Help all families in the future by adjusting the credit for inflation.

As Chairman Smith said on the House floor, H.R. 7024 “removes the penalty for families with multiple children” by adjusting the refundable credit per child. Under current law, the Child Tax Credit increases when a wealthier family has a baby but remains unchanged when a lower-income family has a baby. Although the bill does not eliminate the disparity, it takes a step in recognizing that we should value all of our nation’s children and, at the very least, not discriminate against infants.

The change would have the following effect:

Wealthier families would continue to receive a greater amount per child from the Child Tax Credit. However, eliminating the “child penalty” that is currently imposed upon lower-income kids would reduce the disparity between lower- and higher-income families as portrayed in the chart. It is far from parity, but it is an important step forward for low-income children.

H.R. 7024 also establishes a “lookback” provision to assist the children in families who experience a reduction in income for a variety of reasons (e.g., childbirth, the loss of a job, an economic recession, a natural disaster, divorce, a move, education and training, a health care emergency such as a cancer diagnosis, the need to act as a caregiver for other family members such as a parent, spouse, or child, the lack of affordable child care, the lack of paid family leave, etc.).

As highlighted above, families often experience financial hardship due to the costs of having a baby, the loss of income, and a resulting drop in the Child Tax Credit because the value of the credit it tied to income. The “lookback” provision would allow a family to use a prior year’s income to file for the Child Tax Credit. This change would improve income stability and stop subjecting children and families to cuts at the very time when they most need the credit.

If lawmakers truly value the lives of all babies, they would support public policy changes that recognize and provide more support — not less — to babies to compensate for what economists Marie Connolly and Catherine Haeck also refer to as, “child penalties.”

Again, H.R. 7024 is far from perfect, but it does take these important steps to alleviate some of the provisions of the current Child Tax Credit that adversely impact babies and children.

Opponents Are Seeking to Reimpose the Full “Baby and Child Penalties” and Propose New Ones

Despite the overwhelming passage of H.R. 7024 in the House, support for the legislation from corporate interests for the business tax policies in the package, support from the “pro-life” community for the bill (see also THIS), the disproportionate benefits to children in red states from the Child Tax Credit, and past statements and votes by some Senate Republican lawmakers for the Child Tax Credit, there has been some expressed opposition in the Senate from a few Republican senators concerning the provisions in the bill that reduce the Child Tax Credit’s “child penalties”.

A few of these opponents have called for fully reimposing the “child penalty” for low-income children and eliminating the “lookback” that would stabilize income for families who experience a decline in a year, including the birth of a child.

Would this be good for babies and children? No, it would not.

Furthermore, these reimposed “baby and child penalties” would disproportionately harm children in Republican states.

As if that isn’t bad enough, others are suggesting adding brand new “child penalties” to the Child Tax Credit, such as denying the credit to U.S. citizen children who live in an immigrant household. These mixed-status families, by definition, are working and paying payroll, sales, gas, and property taxes. But more importantly, denying millions of U.S. children access to the Child Tax Credit would increase child poverty, along with child hunger, homelessness, and incidences of child abuse and neglect. Denying the credit also would negatively impact child health and educational outcomes, which would undermine the well-being of U.S. citizen children in the short- and long-term future and threaten our nation’s economic future.

Unfortunately, when people seek to shift the focus of legislation that impacts children from children themselves to the so-called “deservingness” of parents, they often fail to recognize that it is the children who are most negatively impacted by punitive policies. Far too often, children are somehow forgotten or treated as an afterthought, even when the bill has the word “child” in its title.

Commit to Kids

When it comes to policy issues that affect our children, it is time to put their best interests at the forefront of how best to improve their lives and well-being. We call it the “Is it good for the children?” test.

Will the Senate take action that provides a positive answer to this question or will they choose to punish innocent children for the circumstances of their parents or the zip code in which they live?

In light of the compelling evidence and the potential for the Child Tax Credit to dramatically enhance the lives of our youngest citizens, it is crucial that we advocate for policies that uplift rather than penalize children, especially during their most vulnerable early years. The passage of H.R. 7024 in the House is a promising step toward rectifying the "child and baby penalties" and making strides against child poverty. It is a move that not only aligns with our moral imperatives but also with our economic interests, as every child nurtured today can grow into a contributing member of society tomorrow.

We now face a defining moment in the Senate. Will we see a continuation of bipartisan support that recognizes the value of our children, or will we witness a retreat to policies that inadvertently hinder their development? Your voice is crucial in this debate.

Please reach out to your senators and express your support for H.R. 7024 and against amendments that would harm children. Urge them to consider the "Is it good for the children?" test as their guiding principle.

Now is the time for action. Contact your senators today and ask them to commit to kids.

Our kids can’t afford to wait any longer. Two generations have passed since the National Commission on Children recommended a fully refundable Child Tax Credit and other critical investments in our nation’s children.

If we truly believe kids are precious, together we can ensure that sentiment extends beyond just words and into the realm of sustained, supportive action.

***

For a more detailed analysis of the history and the continued need to improve the Child Tax Credit, First Focus on Children has published an issue brief entitled The Child Tax Credit and Its Potential Impact on the Lives of Children and Future of the Nation.

To obtain deeper insights into shaping policy that best supports children through the Child Tax Credit, check out 🎧 Episode #11 of the Speaking of Kids podcast, “Child Poverty in a Policy Decision with Megan Curran and Sophie Collyer.” They explore how improvements to the Child Tax Credit should be made to make significant progress in cutting child poverty in this country.

If you would like to help ensure that children and their needs, concerns, and best interests are no longer ignored by policymakers, please join First Focus Campaign for Children as an “Ambassador for Children” or become a paid subscriber to help us continue our work. We do not have dedicated financial support for this work and rely on readers like yourself to support it. Thank you for your consideration.

Well-said